Five Australian islands on the family business block

For some ultra-wealthy families, they're a place to retreat to, away from the daily business grind and prying public eyes, where they can relax and unwind, in total seclusion. For others, they're actually all about business. In fact, they are the family business.

Whatever their primary purpose, there's certainly no shortage of private investors who already own an island, or who are lining up for a piece of island real estate, in different parts of the globe. And Australia is no exception, where more than a dozen private islands -- mostly in Queensland -- are currently up for sale and attracting interest from families, sole investors and private business consortia.

“A private island is the ultimate trophy asset,” says property developer Nicholas Candy, chief executive of property developers Candy & Candy, whose firm released a report this month in conjunction with Savills World Research and Deutsche Asset & Wealth Management showing Bermuda as the number one spot in the world for high-net worth individuals wanting to buy an island, or island property.

The Bahamas, British Virgin Islands and Antigua all feature in the top five, as does European tax haven, The Channel Islands -- where property prices remained resilient during the global financial crisis.

“The last 10 years were the decade of prime urban property investment; the next 10 years will see a growing appetite for island real estate investment and lifestyle,” says Yolande Barnes, director, Savills World Research. “For the world's wealthy, the pinnacle of achievement is to own what is exclusive and rare, so an island property goes hand-in-hand with a luxury apartment in a prime city.”

A long list of Australian businesspeople, or those doing business in Australia, own islands.

In 2007 billionaire entrepreneur Sir Richard Branson bought a half stake in Makepeace Island, a small heart-shaped island on the Noosa River in Queensland, with the other half already owned by his friend, former Virgin Blue chief executive Brett Godfrey.

Further up the Queensland coastline, north of Townsville, Computershare founder Chris Morris is the proud owner of Opheus Island. He paid $6.25 million for it in 2011, and has reportedly invested a further $5m to expand the island's facilities.

Further up the Queensland coastline, north of Townsville, Computershare founder Chris Morris is the proud owner of Opheus Island. He paid $6.25 million for it in 2011, and has reportedly invested a further $5m to expand the island's facilities.

In the Whitsundays, Linc Energy's Peter Bond paid $8m for the Dunk Island resort, also in 2011. His outlay compares with the $200m spent by Rosemount Estates founder Bob Oatley, and the late Keith Williams, in 2003 for Hamilton Island, while property developer Terry Agnew is pursuing plans for a casino licence as part of his $2 billion redevelopment of Great Keppel Island, which he snapped up for $16.5m in 2006.

Then there's federal politician and billionaire mining and property magnate Clive Palmer, who decided to venture further offshore in 2012 when he paid about $10 million to buy the former Club Med resort at Bora Bora in Tahiti, French Polynesia.

And comedy duo Hamish and Andy have just bought their own island too, signing off on a long-term lease of Iron Islet, south-east of Mackay in Queensland and adjacent to Marble Island, for an undisclosed sum.

For the super rich, islands can certainly make good business sense. But that's not always the case, as they're often hard to sell. Here are the top five Australian islands now on the market.

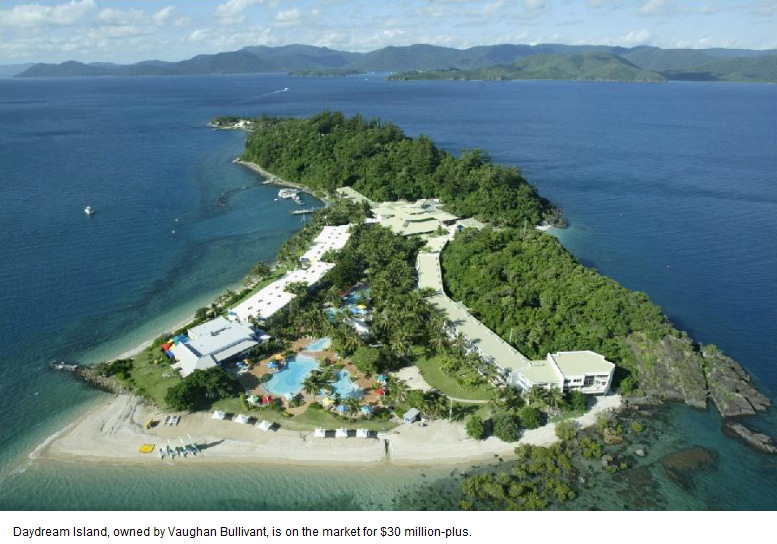

Daydream Island, Queensland (Estimated price tag: $30 million)

Located among Queensland's Whitsunday Islands, this holiday resort island has been on the market for some time already, but final expressions of interest are due in next week (November 6). It's currently owned by Nature's Own vitamins founder Vaughan Bullivant, who bought the 1 kilometre-long island for $12.5m in 2000 using funds from the $135m sale of his business empire. He has reportedly spent a further $60m on upgrades to the island's resort, and was hoping to sell everything for a lock-down price of $65m. But, with no takers at that price, Bullivant has since been forced to more than halve his asking price.

Managing sales agent Wayne Bunz, of CBRE Hotels, says there has been verbal interest from unnamed Chinese investors, Australian high-net worth individuals and a syndicate involving various private wealthy investors. “The challenge is to see who is genuine and who has the financial capability to buy it. We will see what credible offers are made.”

Duke Group Archipelago, Queensland (Estimated price tag: $12 million)

When one island simply isn't enough, why not buy three? First listed for sale in 2011 for an asking price of $15m, the archipelago of Marble Island (1011.7 hectares), Hunter Island (121.4ha) and Tynemouth Island (202.3ha) is still up for sale. Bought by the late Brisbane stockbroker Rex Jones in 1968, and still owned by his son Guy and family, Marble Island was turned into a cattle station, and has since become a haven for hunters and wealthy entrepreneurs. Businessman Geoffrey Edelsten and his former wife Brynne flew up to Marble Island in 2012 with a view to buying, but no offer was forthcoming.

Managing agent and island and resort specialist Richard Vanhoff, of Coldwell Banker Australia, points to renewed, strong, interest in the three islands from Chinese investors who are now “looking very seriously at buying commercial property” before the foreign investment door closes. “At the moment I'm fielding at least a call a day from potential investors, including from potential Chinese buyers,” Mr Vanhoff says.

Clairview Island, Queensland (Estimated price tag: $6 million)

Located off the Capricorn Coast, and bordering the Coral Sea, Clairview Island (266.7ha) is a lush tropical paradise with long, pristine beaches. Owned for many years by a reclusive business family based on the Sunshine Coast, near Noosa, the island is mainly used for farming but has a cottage, two airstrips, a hangar, plans for a beach hut, two dams and farm equipment.

Turtle Island, Queensland (Estimated price tag: $5.7 million)

Located off Gladstone, Queensland, this is the 9.5ha island that actress Julia Roberts reportedly missed out on owning prior to the current owners, a Queensland family, who purchased it about eight years ago. The island comes complete with a four-bedroom, five-bathroom 600 square metre residence with multiple living areas, an in-ground pool, tropical gardens, spectacular views, and a helipad. Mr Vanhoff says he is receiving “a lot of interest” from private Chinese buyers.

Camp Island, Queensland (Estimated price tag: $2.2 million)

Priced to sell, the asking price for Camp Island (7ha) has been marked down from the $3.5m mark and Mr Vanhoff describes it as the “buy of the year”. The island has been owned by three families since the early 1990s, and is under a government lease until 2035. “They [the owners] are prepared to do business on the sale of this island at a reduced price for a quick sale,” he says. Located in Abbot bay, north of the Whitsundays, near Bowen, Camp Island includes a large residence, a pool, tennis court and its own marina, the Silver Shoals Lodge, and a caretaker's lodge.

Family businesses come in all shapes and sizes, and so do islands. With lots of island real estate up for grabs, and some islands being viable businesses in their own right, now could be a great time to kill two birds with one stone.