Elon is Not Alone: Holding Bitcoin on the Balance Sheet

As Bitcoin continues to evolve, some corporate entities have begun to accumulate Bitcoin on their balance sheet.

Apart from the obvious, such as crypto-related companies whose business it is to manage and hold Bitcoin and other digital assets, there are a number of companies that have opted to hold Bitcoin on their balance sheets. While overall a small number, with small amounts, it’s worth looking at whether corporate treasurers are increasingly considering Bitcoin a useful potential hedge against inflation and/or currency debasement.

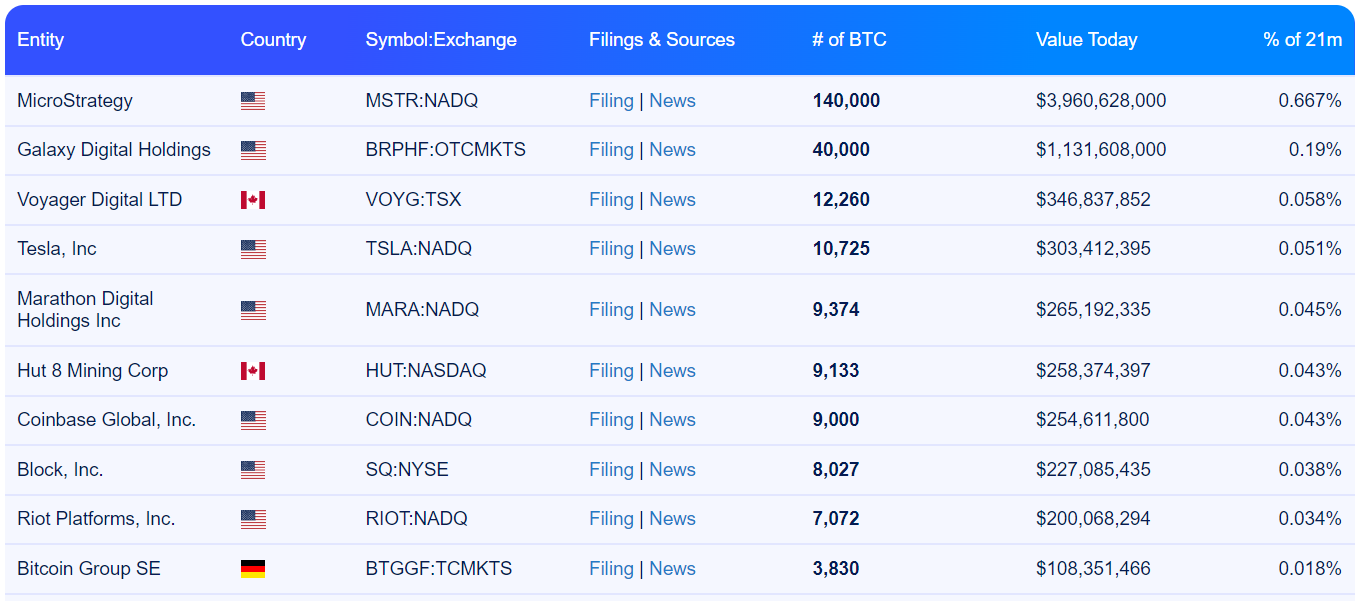

This site maintains a register of public companies with disclosed Bitcoin holdings and the top 10 as of writing are:

Source: https://buybitcoinworldwide.com/treasuries/

At the top of the list by a significant margin is MicroStrategy Inc. (MSTR), a NASDAQ-listed developer of business intelligence software, founded and now chaired by Michael Saylor whose devotion to Bitcoin verges on religious fervour. MicroStrategy holds almost 140,000 BTC as of writing which is 0.67 per cent of total BTC supply (being 21 million once fully issued) and a current market value of some $US3.96 billion.

Saylor’s journey from corporate CEO to Bitcoin evangelist was turbo-charged by the onset of the COVID pandemic and the subsequent era of quantitative easing (QE), leading him to explore several asset alternatives as a store for cash generated by MicroStrategy’s software business. Saylor previously said:

“In March of 2020, the world came to a grinding halt. Suddenly billions of people woke up to the prospect of an economic collapse, losing faith in their institutions and the governments. We saw an escape from economic slavery in the form of what we thought was digital gold.”

A Massachusetts Institute of Technology alumnus in aerospace engineering and a software business founder, Saylor felt Bitcoin’s “digital gold” narrative resonated, ultimately leading to MicroStrategy acquiring 21,000 BTC for $US250 million in mid-2020 and subsequent tranches through 2020. By December 2020, MicroStrategy’s Bitcoin holdings were worth over $US1 billion for its $US500 million investment.

Aggressive Outlier

Fast-forward to now, MicroStrategy has invested nearly $US4 billion to acquire about 130,000 BTC worth $US3.5 billion as of writing. Although slightly underwater still, MicroStrategy remains committed to its Bitcoin strategy. Saylor resigned as MicroStrategy CEO in later 2022 and remained executive chairman focussed on MicroStrategy’s Bitcoin strategy, leaving its CEO to focus on the business intelligence software business to generate cash that can presumably be funnelled into more Bitcoin.

MicroStrategy is an outlier with its aggressive Bitcoin strategy, holding a 56 per cent share of BTC held by the top ten corporates on the list. The balance of the top 10 consists mostly of crypto-related businesses such as the largest US exchange (Coinbase), crypto mining / infrastructure plays (Marathon, Hut8 and Riot), a payments specialist (Block) and crypto funds / financial services (Galaxy, Voyager).

It's unsurprising that crypto businesses might hold Bitcoin or other digital assets on their balance sheet. Their business models involve handling crypto for their customers and so their systems and operations are engineered to do so. They’re also familiar with market volatility, crypto seasonality (eg. Bitcoin’s four-year halving cycle) and risk/return profiles for Bitcoin and other digital assets.

Tesla Bitcoin Holdings

Perhaps the most notable member of the top 10 is Tesla with almost 11,000 BTC worth about $US300 million. Elon Musk’s crypto adventures have been well documented, especially his ongoing dalliance with Dogecoin. Dogecoin was developed in 2013 as a joke and since referenced by Musk on his Twitter feed and his Saturday Night Live appearance in May 2021.

Despite Musk’s apparent interest in Doge (for his own personal entertainment purposes if no other), it was Bitcoin that Tesla acquired in 2021, holding up to 30,000 BTC at one point, but selling off most of its holding during the first half of 2022. As of writing, Tesla still owns more than 10,000 BTC and did not buy or sell any BTC during the last quarter, according to its recent quarterly report.

Given Musk’s long history of unpredictable behaviour, it may be presumptuous to draw conclusions about Tesla’s strategy for acquiring Bitcoin. Does Tesla consider Bitcoin as a place to store treasury reserves rather than cash which is subject to the ravages of inflation and central bank debasement? Does Tesla simply hope to make a return on its holding? Does Tesla have a strategic plan for adopting Bitcoin as a payment method? Or is this just another rash move by Elon Musk in response to a Twitter troll? Only Musk knows.

The site also contains a list of private companies that have disclosed Bitcoin holdings.

One of the more interesting private companies holding Bitcoin is Massachusetts Mutual, a giant of the US insurance industry founded in 1851, #100 on the Fortune 500 list of companies and with $US252 billion in investable assets. MassMutual’s $US100 million investment in Bitcoin is a drop in their balance sheet ocean, but nonetheless represents a surprising call from a 171-year-old conservatively managed insurance company.

MassMutual’s original press release said that its investment gave it a "measured yet meaningful exposure to a growing economic aspect of our increasingly digital world." Given its obligations to pay insurance claims and ongoing annuities, MassMutual’s investment in a highly volatile asset is an intriguing bet that accelerating adoption will continue to drive demand for a fixed supply asset and in turn, a higher Bitcoin price with potentially lower volatility over time.

Despite these interesting edge cases, corporate adoption of Bitcoin or any other digital asset as a treasury reserve remains small. But if adoption continues its upwards trajectory, then corporate treasurers may increasingly consider Bitcoin or other digital asset alternatives as a potential hedge against inflation and/or currency debasement. Like everything in crypto, only time will tell.

Frequently Asked Questions about this Article…

Companies are holding Bitcoin on their balance sheets as a potential hedge against inflation and currency debasement. With the evolving nature of Bitcoin, some corporate treasurers see it as a useful asset to diversify their reserves and protect against economic uncertainties.

MicroStrategy has taken an aggressive approach to Bitcoin investment, holding nearly 140,000 BTC. The company views Bitcoin as 'digital gold' and a strategic asset to store cash generated by its software business. Despite being slightly underwater, MicroStrategy remains committed to its Bitcoin strategy.

Tesla's Bitcoin strategy is notable for its unpredictability, largely influenced by Elon Musk's personal interest in cryptocurrencies. Tesla initially acquired up to 30,000 BTC but sold most of it in 2022. As of now, Tesla holds over 10,000 BTC, but its future strategy remains uncertain and closely tied to Musk's decisions.

MassMutual's investment in Bitcoin is significant because it represents a conservative insurance company's foray into a highly volatile asset. With $US100 million invested, MassMutual aims to gain exposure to the growing digital economy, betting on Bitcoin's potential for higher prices and lower volatility over time.

Corporate adoption of Bitcoin as a treasury reserve is still relatively small, but it is growing. Companies like MicroStrategy and Tesla are leading the way, and if adoption continues to rise, more corporate treasurers may consider Bitcoin as a viable alternative to traditional reserves.