Don't panic when you're still being paid

Recent volatility in share markets around the world sent a lot of investors green in the face. A drop in the index of 1% in one day is unpleasant, but when the benchmark loses more than 3% of its value before lunchtime, as the S&P/ASX200 did on February 9, every investor’s will is tested.

It’s simply a terrible feeling.

Novice investors will question how they were ever talked into putting their money into a market which whips around so irrationally and the experienced ones will grow nervous over their chances of hitting a lofty savings goal. The double-digit returns of past decades will still glow in the minds of some, and it may take years before they realise they need to revise their expectations lower.

DON'T LOSE HEART

When share prices are zipping about like rockets going in the wrong direction it’s worth remembering a well-chosen portfolio of stocks will still be earning income — and it turns out the income produced by Australian shares is far less volatile than the value of the underlying investment.

It’s a bit like the reassurance that you’re being paid for a job that has bad days as well as good ones. You have a hard week at work and come home to have a good grumble, but after you’ve got it out of your system you realise it’s not enough reason to quit. If you did that, the money stops.

With shares, investors are paid to take risks. You have to take the ups with the downs.

THE FLIPSIDE OF EQUITIES

Here’s an illustration of how price volatility and income volatility are very different. It might help investors feel a bit better about owning equities in times of violent ups and downs.

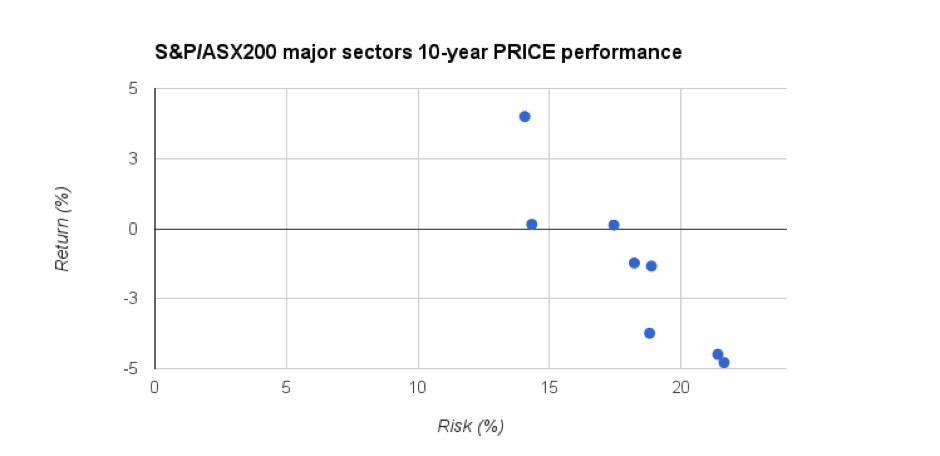

The first chart shows 10-year annualised returns supplied by Morningstar for the ASX200 index and the major sectors within it (A-REITs, consumer discretionary, consumer staples, energy, financials, industrials and materials — excuse us for not labelling the dots but this is more about conveying a message than tempting anyone towards particular parts of the index).

The chart plots results for prices only. Income is not included.

We can see that when averaged over the past 10 years, many of the sectors achieved negative returns. But the risk, which is the variance of annual returns, was between about 13% and 23%. That means the actual annual returns for each of those 10 years were spread wide — say, zero plus or minus about 20% in some cases. There were some very good years and some very bad years.

Now let's look at income.

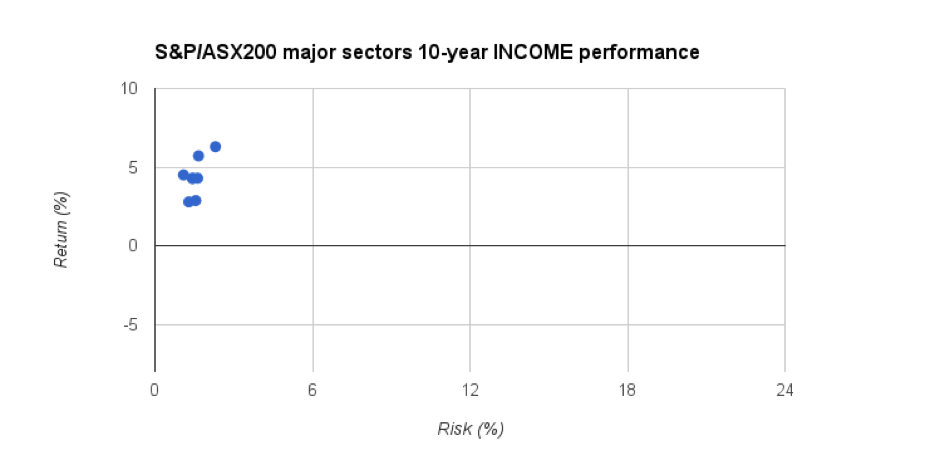

Here we are looking at 10-year annualised results for the same sectors, but this is income only. The wild oscillations in price performance do not show up here.

Obviously return is always positive, because a company cannot ask an investor to pay it any income. Dividends are for the investor to enjoy.

But look at the risk levels, which are very low. Over the past 10 years income paid to investors has been pretty steady, generally fluctuating by less than about 3% upwards or downwards each year.

SILVER LINING

Two key criteria for sizing up any investment are growth and income. Sometimes you can strike gold and get lots of both, but most often it comes down to living with the fact that you’ll have to settle for one or the other. Growth and income tend to sit on a seesaw. A high-growth investment can be expected to pay little or no income; the price of an income stock won’t factor in much room for rapid growth.

So the next time the markets slap your capital down, tell yourself the income coming off your holdings will probably hold steady.

Of course, Australia could enter another recession and the banks could cut their dividends. Low income volatility of the past 10 years may not last.

Be prepared. Maybe it’s time to consider a balanced, professionally managed portfolio?

Frequently Asked Questions about this Article…

Share markets experience volatility due to various factors, including economic changes, investor sentiment, and global events. This can lead to rapid fluctuations in stock prices, which can be unsettling for investors.

Novice investors should remain calm during market volatility. It's important to remember that a well-chosen portfolio can still generate income despite price fluctuations. Patience and a long-term perspective are key.

Price volatility refers to the rapid changes in stock prices, while income volatility pertains to the fluctuations in dividends or income from stocks. Income from Australian shares tends to be more stable compared to their price.

Investors can benefit from holding equities during volatile times by focusing on the steady income generated from dividends. This income can provide reassurance even when stock prices are fluctuating.

The risks associated with investing in equities include price volatility and the potential for negative returns in certain years. However, income from dividends tends to be more stable, offering a buffer against price swings.

Over the past decade, income from Australian shares has been relatively stable, with fluctuations generally less than about 3% each year. This stability can be reassuring for investors during volatile market periods.

Investors should consider their financial goals and risk tolerance when choosing between growth and income investments. High-growth investments may offer little income, while income stocks might not provide rapid growth.

Given the potential for market volatility and economic changes, it might be a good time to consider a balanced, professionally managed portfolio. This can help mitigate risks and provide a more stable investment experience.