Diversified Portfolio - Fixed Income - 30 April 2016

COMMENTARY

PORTFOLIO COMMENTARY

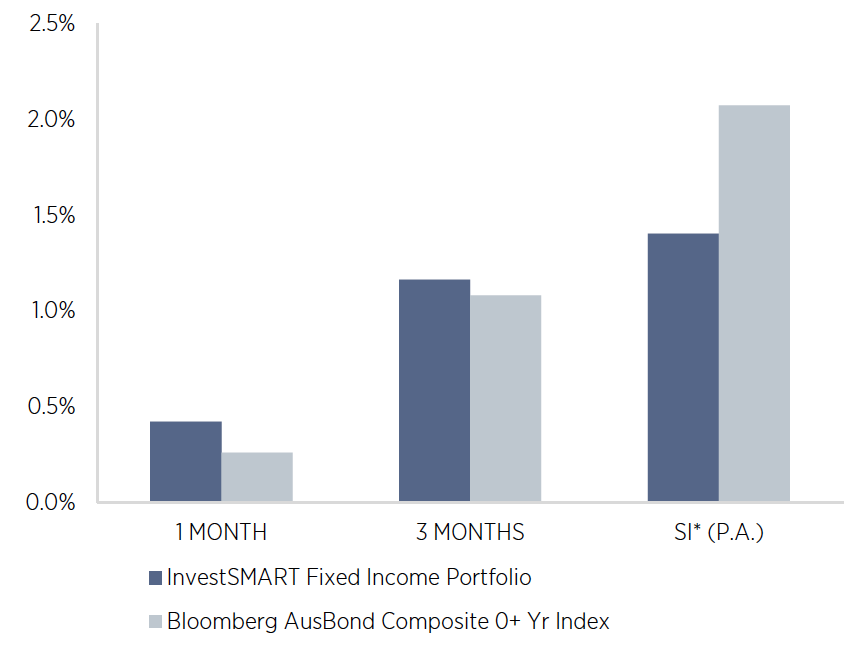

The InvestSMART Fixed Income Portfolio produced a return of 0.4% which was better than the return available from cash deposits and ahead of the 0.3% return from the Australian composite bond index.

During the last year both cash and Australian Government Bonds have generated returns of around 2-3%. However, during that period bonds have been much more volatile, falling by more than 3% at one point last year.

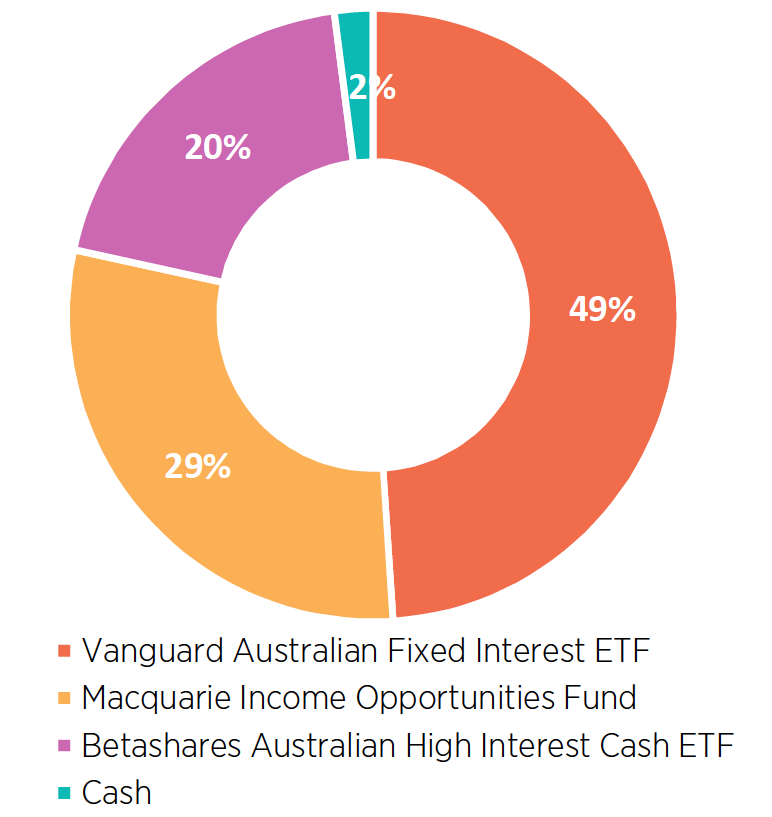

Looking forward we believe that further volatility in fixed income bond markets is likely and that the yield to maturity of less than 2.5% is insufficient to compensate investors for that risk. This also materially contributes to the risk of fall short of the medium term objective of outperforming. With that in mind we have invested around half of the portfolio in cash and a managed fund that invests predominantly in floating rate corporate bonds. This means that the portfolio will deviate from the stated benchmark from one month to the next but over the next three years we expect it should achieve a higher return with less volatility.

Holdings

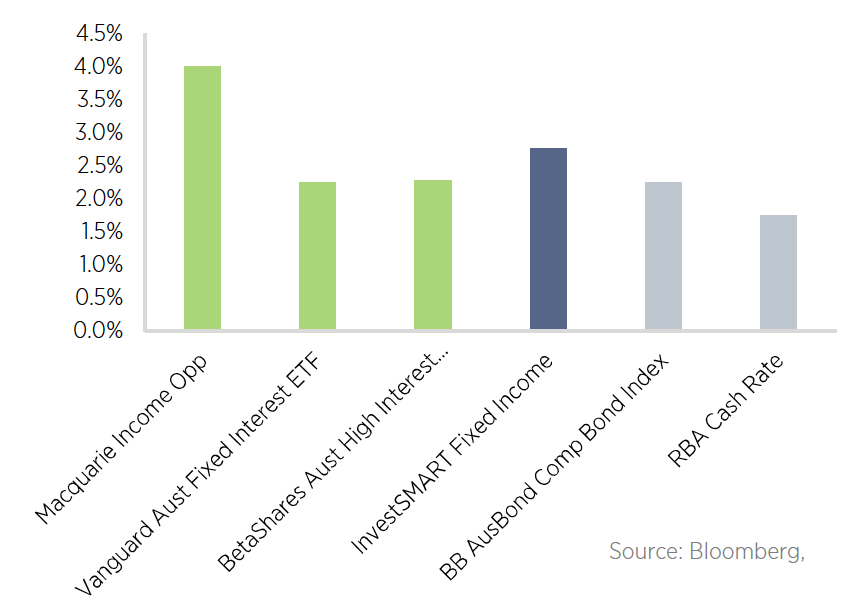

Estimated yield

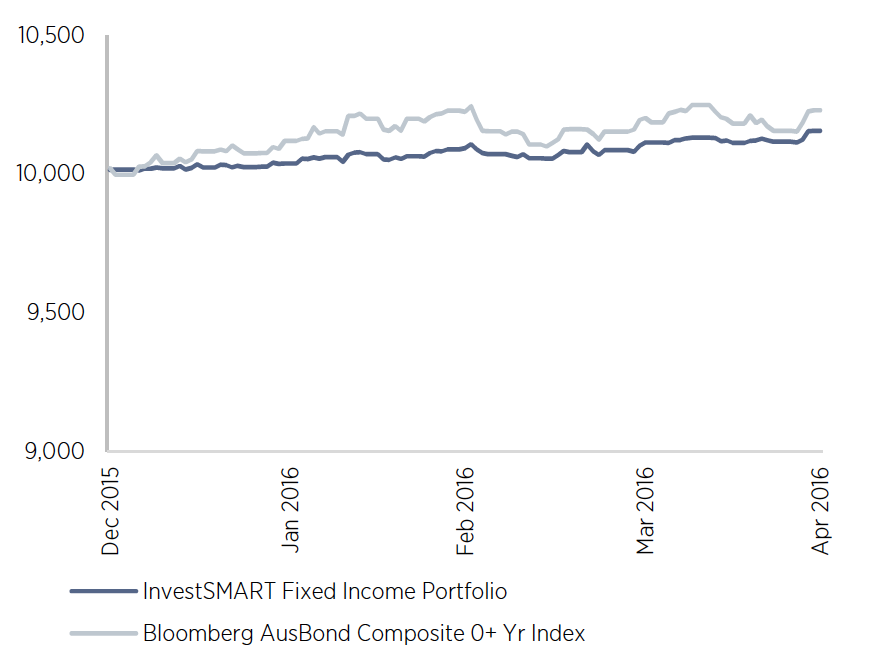

Growth of $10,000

Income Reinvested

PERFORMANCE SUMMARY TO 30 APRIL 2016

Source: Praemium, RBA.

Returns are before expenses and fees. Returns are shown as annualised if the period is over 1 year. * Since Inception (SI) date is 22 December 2015.

| PERFORMANCE TO 30 APRIL 2016 | 1 MONTH | 3 MONTHS | SI* (P.A.) |

|---|---|---|---|

| InvestSMART Fixed Income Portfolio | 0.42% | 1.16% | 1.40% |

| Bloomberg AusBond Composite 0 Yr Index | 0.26% | 1.08% | 2.07% |

| Excess to Benchmark | 0.16% | 0.08% | -0.67% |

Important Information

While every care has been taken in preparation of this document, InvestSMART Financial Services Limited (ABN 70 089 038 531, AFSL 226435) (“InvestSMART”) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and see professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document has been prepared for InvestSMART by InvestSense Pty Ltd ABN 31 601 876 528, Authorised Representative of Sentry Asset Management Pty Ltd AFSL 408 800. Financial commentary contained within this report is provided by InvestSense Pty Ltd. The information contained in this document is not intended to be a definitive statement on the subject matter nor an endorsement that this model portfolio is appropriate for you and should not be relied upon in making a decision to invest in this product. The information in this report is general information only and does not take into account your individual objectives, financial situation, needs or circumstances. No representations or warranties express or implied, are made as to the accuracy or completeness of the information, opinions and conclusions contained in this report. In preparing this report, InvestSMART and InvestSense Pty Ltd has relied upon and assumed, without independent verification, the accuracy and completeness of all information available to us. To the maximum extent permitted by law, neither InvestSMART, InvestSense Pty Ltd or their directors, employees or agents accept any liability for any loss arising in relation to this report. The suitability of the investment product to your needs depends on your individual circumstances and objectives and should be discussed with your Adviser. Potential investors must read the PDS, Approved Product List and FSG along with any accompanying materials. Investment in securities and other financial products involves risk. An investment in a financial product may have the potential for capital growth and income, but may also carry the risk that the total return on the investment may be less than the amount contributed directly by the investor. Past performance of financial products is not a reliable indicator of future performance. InvestSense Pty Ltd does not assure nor guarantee the performance of any financial products offered. Information, opinions, historical performance, calculations or assessments of performance of financial products or markets rely on assumptions about tax, reinvestment, market performance, liquidity and other factors that will be important and may fluctuate over time. InvestSense Pty Ltd, InvestSMART Financial Services Limited, its associates and their respective directors and other staff each declare that they may, from time to time, hold interests in Securities that are contained in this investment product.

Frequently Asked Questions about this Article…

The InvestSMART Fixed Income Portfolio is an investment strategy that aims to provide returns higher than cash deposits and the Australian composite bond index by investing in a mix of cash and floating rate corporate bonds.

In April 2016, the InvestSMART Fixed Income Portfolio achieved a return of 0.4%, outperforming both cash deposits and the Australian composite bond index, which returned 0.3%.

The portfolio includes floating rate corporate bonds to reduce volatility and potentially achieve higher returns over the next three years, as fixed income bond markets are expected to remain volatile.

The expected yield to maturity for the portfolio is less than 2.5%, which is considered insufficient to compensate for the risk of volatility in the bond markets.

The portfolio outperformed the Bloomberg AusBond Composite 0 Yr Index in April 2016, with a return of 0.42% compared to the index's 0.26%.

Investing in the portfolio involves risks such as market volatility and the potential for returns to be less than the amount invested. Past performance is not a reliable indicator of future performance.

The suitability of the portfolio depends on individual circumstances and objectives. Investors should consider their financial situation and seek professional advice before investing.

Investors should read the Product Disclosure Statement (PDS), Approved Product List, and Financial Services Guide (FSG) to understand the risks and suitability of the investment for their needs.