Digital Assets Regulation Gains Traction

While news of crypto-friendly bank busts and volatile markets dominate the current news cycle, work continues behind the scenes to position Australia to maximise the emerging opportunities in the digital asset space.

Providing regularity clarity to market participants and consumers is a key milestone along the path, as recent events involving Binance demonstrate. The world’s largest crypto exchange, with group revenue of around $A30 billion and some 30 million users (including 200,000 or so in Australia), Binance and its founder and CEO Changpeng Zhao (aka CZ) is being sued for breaches of US trading law by the US regulator, the Commodity Futures Trading Commission (CFTC).

Liberal Senator Andrew Bragg recently submitted a private senators’ bill titled Digital Assets (Market Regulation) Bill 2023 to “protect consumers and promote investors”. The draft bill includes regulatory recommendations for stablecoins, licensing of exchanges and custody requirements.

Getting Moving

Bragg believes that Australia’s parliament should provide regulatory clarity over key aspects of the digital asset economy, saying “The government’s taking forever, and we just want to get things moving”.

The draft bill’s outline says:

“In October 2021, the Senate Select Committee on Australia as a Technology and Financial Centre published its final report. The report included 12 recommendations, 11 of which were agreed to in principle by the Government of the day.

The Digital Assets (Market Regulation) Bill 2023 implements the first two recommendations of the Committee report and addresses the need to regulate central bank digital currencies in Australia. The Bill provides for the following:

- digital asset exchange authorisation and requirements;

- digital asset custody authorisation and requirements;

- stablecoin issuance authorisation and requirements; and

- disclosure requirements for facilitators of central bank digital currencies in Australia.

Key Aspects

Licensing is a key aspect of the draft bill, proposing a regime for Australian providers of exchanges, custody services and stablecoin issuance. ASIC would be empowered to enforce the legislation via monitoring and investigation powers.

Specific obligations would include capital requirement buffers to handle market downturns, conduct regulation and governance related to monitoring and procedures, segregation of customer funds from funds belonging to the provider, compliance with appropriate IT security standards, disclosure obligations including to statutory authorities, and auditing / reporting requirements.

Any stablecoin issuers would need to back the face value of their tokens with Australian dollars held with an Approved Deposit-Taking Institution (ADI). ADI’s managing Central Bank Digital Currencies (CBDCs) issued by foreign entities would also need to meet reporting disclosures to ASIC and the RBA.

The Treasury department also recently issued a paper on “token mapping”, which aims to be “a foundational step in the Government’s multi‑stage reform agenda that commits to developing appropriate regulatory settings for the crypto sector”.

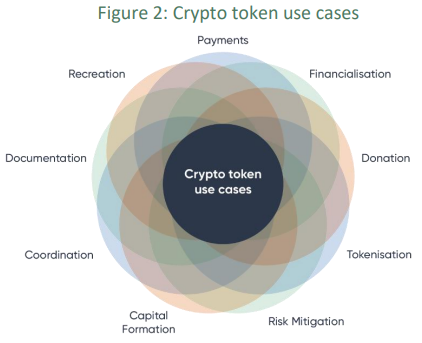

Token mapping is defined as “the process of identifying the key activities and functions of products in the crypto ecosystem and mapping them against existing regulatory frameworks”. The paper illustrates several potential use cases for crypto tokens:

Source: https://treasury.gov.au/sites/default/files/2023-02/c2023-341659-cp.pdf

Treasury is adopting a token mapping approach described by the Bank for International Settlements (BIS) as it aligns with Australia’s historical stance on financial industry regulation, including (i) a technology neutral stance (which was identified as far as back as the 1996 Wallis Inquiry into regulatory reform within the banking sector and 2014’s Financial System Inquiry), and (ii) a functional approach that regulates functionally equivalent products equally. These two pillars ensure regulatory flexibility as both technology and functionality evolve over time. This is especially important for the crypto / digital asset space which is emerging and fast moving.

The point of token mapping is for policy makers and stakeholders to reach a consensus about the meaning of emerging concepts in the crypto space by identifying:

- “the elements of the crypto ecosystem that fall inside and outside the existing regulatory perimeters;

- the key risks that are added or removed by products using crypto networks;

- the sensible regulatory targets for a future regulatory framework; and

- the legitimate technical criticism and anticipated opportunities of the technology.”

Both initiatives demonstrate intent on the part of our policy makers and regulators to create a regulatory framework that is fit for purpose in addressing the risks, challenges, and opportunities of the emerging digital asset space.

But most importantly for investors, they show that government sees potential for the digital asset space to “open significant new opportunities for businesses and consumers alike, creating jobs and fostering innovation”. So while the latest meme coin or crypto criminal may take the spotlight, meaningful developments are occurring behind the scenes, including regulatory reform which is a key foundation for the growth of a crypto economy.

Frequently Asked Questions about this Article…

The Digital Assets (Market Regulation) Bill 2023 is a proposed legislation in Australia aimed at providing regulatory clarity for the digital asset economy. It includes recommendations for stablecoins, licensing of exchanges, and custody requirements. For investors, this means a more secure and transparent environment for digital asset transactions, potentially reducing risks associated with crypto investments.

The proposed regulation would require crypto exchanges like Binance to obtain proper licensing and adhere to specific obligations such as capital requirement buffers, segregation of customer funds, and compliance with IT security standards. This aims to enhance the safety and reliability of crypto exchanges for investors.

Token mapping is the process of identifying and categorizing the key activities and functions of crypto products against existing regulatory frameworks. It is important because it helps policymakers and stakeholders understand the crypto ecosystem, identify regulatory gaps, and develop a framework that addresses the risks and opportunities in the digital asset space.

Regulatory clarity is crucial for the growth of the digital asset economy because it provides a stable and secure environment for investors and businesses. It helps mitigate risks, fosters innovation, and opens up new opportunities by ensuring that digital asset activities are conducted within a well-defined legal framework.

The regulation of stablecoins would require issuers to back their tokens with Australian dollars held with an Approved Deposit-Taking Institution (ADI). This ensures that stablecoins maintain their value and reliability, providing everyday investors with a more secure and trustworthy option for digital transactions and investments.