Crunching the Numbers For a Pension

The age pension asset test means that the more you save for retirement, the less age pension you receive.

However, the current ‘balance’ between extra assets and age pension lost means that you might lose more age pension income than the extra assets earn for you.

Let’s start with some numbers - keeping in mind this article focusses on the way the asset test reduces access to the age pension, and has considered the income test.

Number 1: $38,064

The full age pension is $38,064 per year (the basic rate, not including the pension supplement and energy supplement which take it to $41,704). Because this article deals with broad concepts, we will focus on the basic figures rather than detail.

Number 2: $53,224

Let’s assume that a couple have $40,000 of lifestyle assets (car and furniture). The age pension rules say that a couple can have $419,000 of assets between them before they lose any age pension. So, they can have $379,000 of financial assets, plus the $40,000 of lifestyle assets and still receive the full age pension. I think a conservative, sustainable, long-term drawing rate from financial assets is 4% to 5% per year. Let’s use the bottom of this range, so they draw (4% x 379,000) $15,160 annually from their financial assets alongside their $38,064 in age pension to have $53,224 per year in retirement.

Number 3: $45,700

Now, let’s go to the other end of the spectrum – a couple who just miss out on the age pension because they have too many assets, $954,000 in total as a homeowning couple. Once you have $954,000 of assets as a homeowning couple, you will not receive any part-age pension. Assuming the couple have $40,000 of lifestyle assets, that means they have $914,000 of financial assets. If they decide that a conservative, sustainable rate of drawing is 4% a year, they will receive $36,560 per year. If they decide to withdraw at a higher 5% rate, they will receive $45,700.

Clearly this is a financially awkward situation. The couple with $379,000 of financial assets has an income (that will almost certainly be tax-free) of $53,224 with the underlying security that the majority of the income is a government payment that increases with inflation, without the investment risk of share price volatility or periods of very low interest rates of cash. The homeowning couple with $914,000 of financial assets receives around $7,000 per year, or $140 per week, less.

Why Does This Anomaly Exist?

There are some more numbers here that can clearly show us why this situation exists.

At $379,000 of assets a couple receives $38,064 in age pension.

At $914,000 of assets a couple receives $0 in age pension.

The $535,000 of assets ($914,000 - $379,000) ‘costs’ the couple $38,064 of age pension income. That is an effective yield of -7% per annum. (-38,064/535,000). A balanced portfolio of investments is unlikely to produce investment returns of 7% per annum above the rate of inflation (remembering that the age pension is indexed).

It is worth noting that the age pension has not always decreased as quickly with additional assets. In 2017 the rate at which the age pension decreased with extra assets was doubled.

Are You Better Off With Less?

At first glance, it seems that you might even be better off with fewer assets – target around $380,000 in retirement assets and enjoy a comfortable retirement of $53,000 per year or just over $1,000 per week tax free. That income, with your own home, sounds very reasonable.

However, there are any number of advantages to having more money, including:

- You have access to lump sums, including large lump sums, when you need them

- There is more control around when you spend your money

- If your portfolio falls in value, you have the ‘safety net’ of access to a part age pension

How Can We React?

The first reaction might be at a collective level – pressure on the government to return to an asset test taper rate similar to that which existed prior to the 2017 changes would improve the incentives in the system for people to keep saving for their retirement, beyond the point where they have saved around $380,000 so that they lose access to the age-pension at a slower rate.

The second level is to look at these numbers and think about how a couple retiring at age 67 might react. Let’s start by considering a couple with $914,000 of financial assets (and $40,000 of lifestyle assets) who receive no part age pension (because they are just at the asset test limit). Should they draw from their portfolio at a relatively sustainable rate of, say, 5%, giving them $47,500 per annum (assuming a balanced portfolio that includes both growth assets like shares and defensive assets like cash and fixed interest)?

While it is not possible to answer for everyone – some people might like to be self-funded and are content at withdrawing from their portfolio at a sustainable rate – I suspect most people will feel that they are entitled to a little more income if they can find a sensible way to generate it.

Let’s start with a ‘base case’ scenario. We know that around $380,000 of assets for a couple, being drawn on at the conservative rate of 4% per annum produces $15,160 of income, and with $38,064 age pension provides $53,224 of annual retirement income (that you can expect to increase with inflation).

This should be a baseline position – if financial assets of $380,000 generates a total retirement income of $53,224, then there is no reason someone with higher levels of assets shouldn’t have a little more to live on, provided that if their assets fall to the level of $380,000 (because they are drawing at a higher rate than a sustainable 4 to 5% per year), they are comfortable living on $53,224 per year.

If a homeowning couple has a higher level of assets, let’s say $914,000 of assets, and they are comfortable with this ‘base case’ position of $53,224 of income with $380,000 of assets, my suggestion would be to calculate their retirement income based on withdrawing from their portfolio at a rate of 7% per annum.

So, with $914,000 of assets they would be withdrawing (7% x 914,000), or $63,980.

Now, if we assume an average portfolio return of 5% after inflation, the portfolio will earn $47,500, meaning it will fall in value by $18,280. However, this now means than in the next year the person will receive some part age pension for extra income.

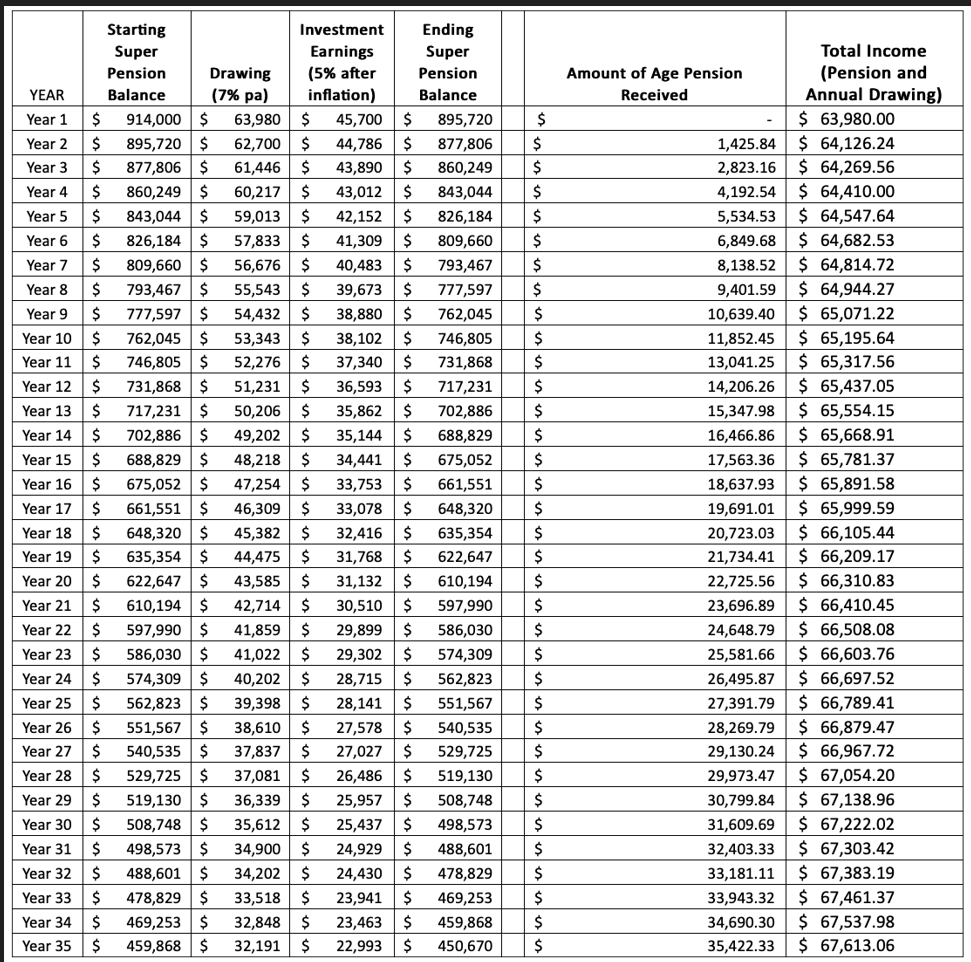

The following table shows what happens year by year, assuming a 5% earnings rate above inflation, age pension and asset test increasing by inflation, and a 7% drawdown rate. All figures are in today’s dollars, assuming the pension age pension increases with inflation, and investment returns are after inflation. Even after 35 years (a couple starting at age 67 at age 102), and drawing at a rate of 7% per annum, there remains enough capital that they have not got to the point where they receive the full age pension.

Conclusion

This is not a simple concept. It will be one that anyone receiving a part age pension, or assets that are just over the cut-off for an age pension, will be familiar with.

While there is no easy answer, thinking about drawing a higher income than you might have considered from your retirement assets, supported by an increasing part age pension as your assets fall, is worth considering as a strategy to make sure that your efforts in saving an increased retirement balance translates into a little extra money to spend during retirement.

Resources:

Frequently Asked Questions about this Article…

The age pension asset test reduces the amount of age pension you receive as your assets increase. This means that the more you save for retirement, the less age pension you might get. It's important to balance your savings to maximize your retirement income.

The full age pension is $38,064 per year, not including additional supplements like the pension supplement and energy supplement, which can increase it to $41,704. This amount is indexed to inflation, providing a stable income source.

With fewer assets, you might qualify for a higher age pension, which can provide a stable, tax-free income that increases with inflation. For example, a couple with $379,000 in financial assets can receive a total income of $53,224 per year, combining their pension and asset drawdown.

Having more assets gives you access to larger lump sums when needed, more control over your spending, and a safety net if your portfolio value decreases. It allows for flexibility and potential for higher income through strategic withdrawals.

Consider withdrawing from your portfolio at a higher rate, such as 7% per annum, if you have significant assets. This strategy can provide a higher income initially and may lead to receiving a part age pension as your assets decrease over time, ensuring a steady income throughout retirement.