Bitcoin: The State of Play in 2022

Amid the booming crypto space last year and the emergence of NFTs, DeFI, stablecoins and putative Ethereum “killers”, Bitcoin made it to an all-time high of $A93,000 on 11 August.

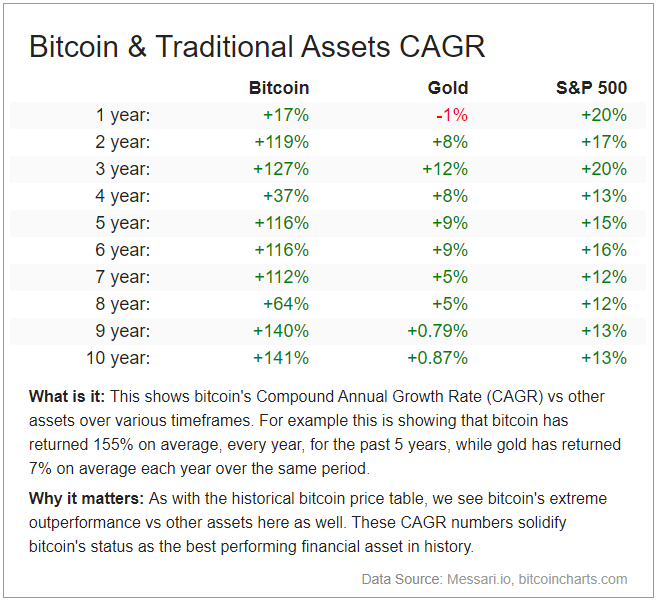

It ended 2021 at $A64,000 having risen from $40,000 or so at the start of the year. For the calendar year Bitcoin’s return was 160 per cent. As previously discussed on Eureka Report, Bitcoin’s compound annual growth rate has significantly outpaced both gold and the S&P500 for the last decade:

Source: https://casebitcoin.com/charts

2022 will likely prove to be a more challenging market for Bitcoin due to the prospect of lower Fed balance sheet expansion and rising interest rates, a “risk-off” rotation, and the potential for other crypto assets to attract funds out of Bitcoin due to their greater momentum (notwithstanding recent downwards price action).

Bitcoin’s dominance, or percentage of total crypto market cap, has fallen from around 70 per cent at the end of 2020 to 42 per cent as of writing, based on Bitcoin’s market cap of $US700 billion and a total crypto market cap of $US1.7 trillion (https://coinmarketcap.com/) due to the rise of these emerging crypto asset classes.

This is close to its all-time-low of around 37 per cent in early 2018, just after the crash from the then all-time-high of around $A27,000, demonstrating the rotation into riskier crypto assets in recent months.

Since the start of January, Bitcoin has fallen to around $A52,000 as of writing from its $A66,000 close as crypto markets fell across the board responding to the “risk-off” sentiment (it fell as low as $A46,000 but bounced off the low). Jittery market behaviour is likely to persist resulting in volatile price action in the shorter term.

But for many family office, corporate, institutional and nation state investors, Bitcoin remains the “first choice” asset for long-term crypto exposure due to its predictable supply schedule, demonstrated protocol resilience, return-on-investment (ROI) track record over more than a decade, and ever-growing user adoption. Bitcoin is widely recognised as digital property or digital “gold” and therefore a store-of-value (albeit volatile). Regulators have increasingly acknowledged this, providing growing comfort to investors and market participants.

Other crypto assets including Ethereum are considered more like digital “securities”, or akin to equities and potentially subject to securities-like regulation. This is because all crypto assets except Bitcoin are widely considered to be centralised, relatively speaking. Evolving regulation may alter the dynamics of non-Bitcoin crypto.

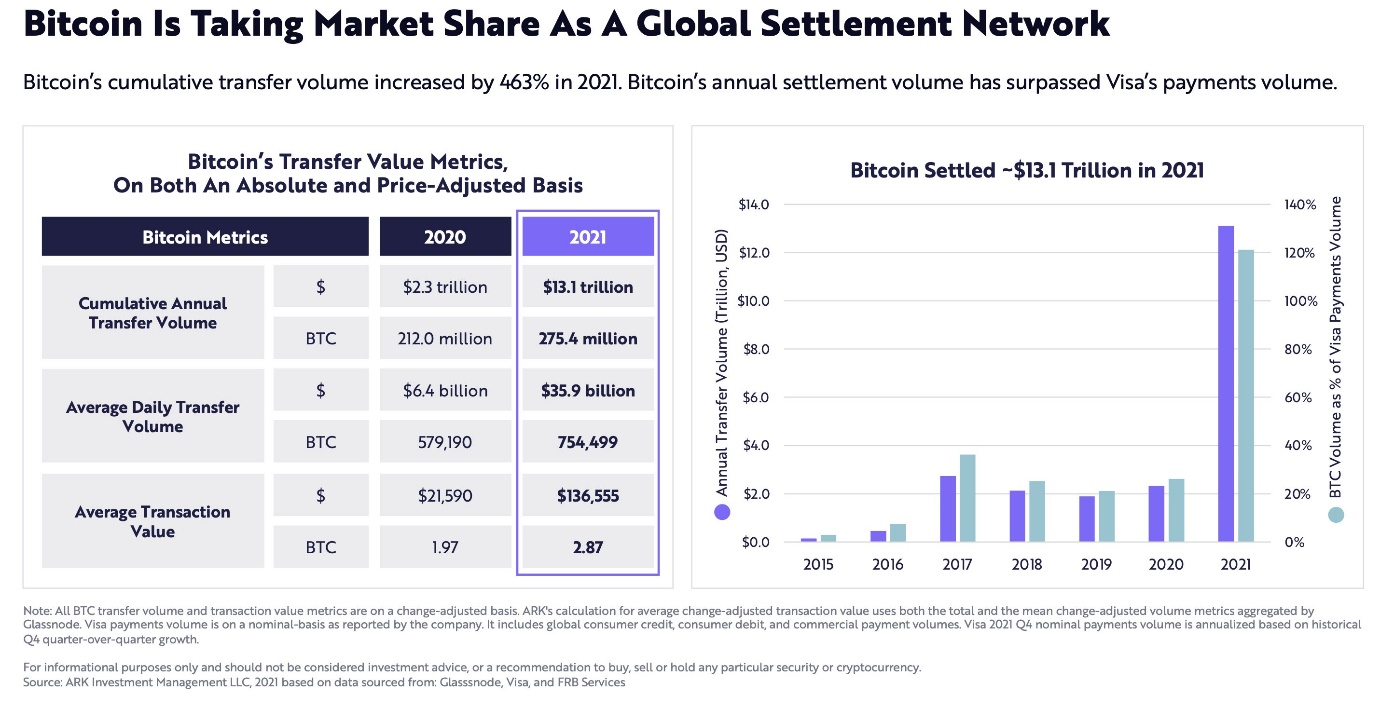

The Bitcoin network’s settlement volume continues to grow too, emphasising its value as a settlement layer. In 2021, Bitcoin’s annual settlement volume exceeded Visa’s payments volume, a fact missed by many casual observers, but not by educated professional investors.

Source: https://ark-invest.com/

Since the liquidity crisis caused by the onset of COVID-19 in March 2020 and the subsequent money printing by central banks worldwide, many high-profile professional investors have made public statements in support of Bitcoin, including:

- Paul Tudor Jones, Founder Tudor Investments, $US38 billion assets under management (AUM):

- “I think we are in the first innings of Bitcoin and it’s got a long way to go. Bitcoin has this enormous contingence of really, really smart and sophisticated people who believe in it ... It’s like investing with Steve Jobs and Apple or investing in Google early. I've never had an inflation hedge where you have a kicker that you also have great intellectual capital behind it, so that makes me even more constructive on [Bitcoin]”.

- “I think we are in the first innings of Bitcoin and it’s got a long way to go. Bitcoin has this enormous contingence of really, really smart and sophisticated people who believe in it ... It’s like investing with Steve Jobs and Apple or investing in Google early. I've never had an inflation hedge where you have a kicker that you also have great intellectual capital behind it, so that makes me even more constructive on [Bitcoin]”.

- Bill Miller, Founder Miller Value Funds, $US2.7 billion AUM:

- “I think the average investor should ask himself or herself, what do you have in your portfolio that has that kind of track record – number one, is very, very under-penetrated; can provide a service of insurance against financial catastrophe that no one else can provide and can go up 10 times or 50 times? The answer is: nothing”.

- “I think the average investor should ask himself or herself, what do you have in your portfolio that has that kind of track record – number one, is very, very under-penetrated; can provide a service of insurance against financial catastrophe that no one else can provide and can go up 10 times or 50 times? The answer is: nothing”.

- Stanley Druckenmiller, Founder Duquesne Capital; Managing the Quantum Fund with George Soros, net worth $US6 billion:

- “I have warmed up to the fact that Bitcoin could be an asset class that has a lot of attraction as a store of value to both millennials and the new west coast money, and as you know they've got a lot of it. It's been around for 13 years, and with each passing day, it picks up more, more of its stabilization as a brand... Frankly if the gold bet works, the bitcoin bet will probably work better”.

- “I have warmed up to the fact that Bitcoin could be an asset class that has a lot of attraction as a store of value to both millennials and the new west coast money, and as you know they've got a lot of it. It's been around for 13 years, and with each passing day, it picks up more, more of its stabilization as a brand... Frankly if the gold bet works, the bitcoin bet will probably work better”.

- Rick Rieder, CIO BlackRock Global Fixed Income & Head of Global Allocation, $US7.3 trillion AUM:

- “Do I think [Bitcoin] is a durable mechanism that will take the place of gold to a large extent? Yeah I do...”.

- “Do I think [Bitcoin] is a durable mechanism that will take the place of gold to a large extent? Yeah I do...”.

- Tom Fitzpatrick, MD Citibank,$US21 trillion AUM:

- “Bitcoin is the new Gold. It is an asset with limited supply. It is digital (This is the 21st century- Gold is a 20th century asset). It moves across borders easily and ownership is opaque. That last point is, I believe, very relevant. The huge fiscal deterioration of today has a cost in the future, either directly or indirectly. Directly it is that at some point the 'bills have to be paid' which means at some time in the future the money needs to be found. While Bitcoin may become subject to more regulatory constraints going forward it is a natural store of 'money' to avoid this. Indirectly the argument can be the debasement of FIAT currencies by creating high nominal growth and inflation”.

- “Bitcoin is the new Gold. It is an asset with limited supply. It is digital (This is the 21st century- Gold is a 20th century asset). It moves across borders easily and ownership is opaque. That last point is, I believe, very relevant. The huge fiscal deterioration of today has a cost in the future, either directly or indirectly. Directly it is that at some point the 'bills have to be paid' which means at some time in the future the money needs to be found. While Bitcoin may become subject to more regulatory constraints going forward it is a natural store of 'money' to avoid this. Indirectly the argument can be the debasement of FIAT currencies by creating high nominal growth and inflation”.

- Tim Corbet, CIO Mass Mutual, $US567 billion AUM:

- “Bitcoin’s unique characteristics—including digital scarcity, known supply growth, transfer characteristics, and hard cap on the total number of tokens—open the possibility that it may serve as a kind of ‘digital gold’ with the potential for significant price appreciation”.

- “Bitcoin’s unique characteristics—including digital scarcity, known supply growth, transfer characteristics, and hard cap on the total number of tokens—open the possibility that it may serve as a kind of ‘digital gold’ with the potential for significant price appreciation”.

- Ray Dalio, Founder Bridgewater Associates, $US140 billion.

- “…has some merit as a small portion of a portfolio”.

Bitcoin’s increasing legitimacy from professional investors (some, at least) has accelerated during a period of heavy money printing, especially in the US. Since the Fed foreshadowed a likely tapering of its money printing program, Bitcoin’s price has fallen along with a general rotation from “risk-on” assets to safer harbours.

For long term Bitcoin “hodlers” (sic) with high conviction, this may prove to be good opportunities to buy. Previous sideways or bearish conditions for Bitcoin have proven so.

The bull case for Bitcoin remains the indisputable trend for the ongoing digitalisation of almost every aspect of the economy. It has the longest track record, the most resilient decentralised network, the buy-in of (some) professional investors and (some) regulators and is the most recognisable crypto globally. If Bitcoin is a manifestation of the digitalisation of “money” or “gold” or “store of wealth”, then the long-term tailwinds remain strong.

But it remains a highly volatile asset class and interested investors should allocate according to their risk profile.

Frequently Asked Questions about this Article…

In 2021, Bitcoin reached an all-time high of $A93,000 on August 11 and ended the year at $A64,000, having risen from around $40,000 at the start of the year. This marked a 160% return for the calendar year.

2022 could be challenging for Bitcoin due to factors like lower Fed balance sheet expansion, rising interest rates, and a 'risk-off' rotation. Additionally, other crypto assets with greater momentum might attract funds away from Bitcoin.

Bitcoin's market dominance has decreased from around 70% at the end of 2020 to 42% as of the article's writing. This decline is due to the rise of emerging crypto asset classes.

Bitcoin is often seen as 'digital gold' because of its predictable supply schedule, demonstrated protocol resilience, and its role as a store-of-value. Its increasing legitimacy among professional investors and regulators also supports this view.

Prominent investors like Paul Tudor Jones, Bill Miller, and Stanley Druckenmiller have expressed support for Bitcoin, citing its potential as a store of value, its track record, and its appeal to new generations of investors.