Are recessions a good time to invest?

When it comes to past recessions, the Mark Twain quote, ‘History never repeats, but it often rhymes’ certainly applies. No two recessions have ever been the same, but they often have similar characteristics.

Recessions are defined technically as two continuous quarters of negative GDP growth, but they are also known as a significant and widespread downturn in economic activity that lasts for a sustained period.

Many economies have recessions every seven to ten years, but in Australia we have had slightly fewer due to our resources sector and proximity to China. Our most recent technical recession was after the covid crash in 2020.

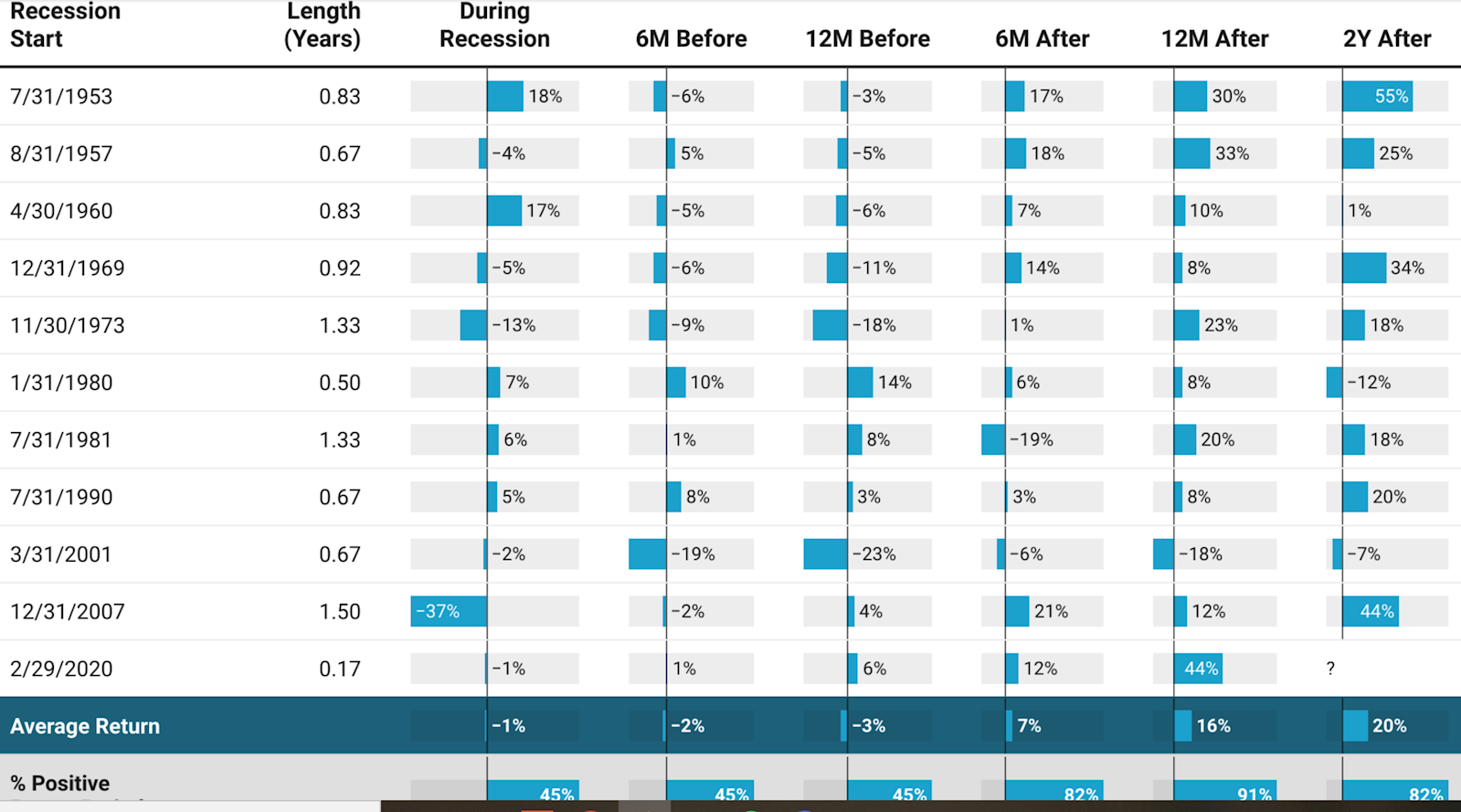

As per the below chart from Darrow Investment Management, in the US they have had 11 recessions since 1948, and the chart shows how the S&P 500 fared through each of these recessions.

Please note that the returns on the chart are cumulative (actual) returns, and not annualised returns.

The chart shows some interesting patterns. In the 12 months before a recession occurs, the S&P 500 on average fell 3%. During a recession, the results were mixed, with the market having ups and downs, but on average dropping 1%. However, after a recession, the market almost always makes good gains, with the market rising on average 20% after two years.

Though these results are probably what you’d expect, it’s still interesting to see it visualised, as it shows what may happen when we move out of the current downturn.

Navigating Recessions

For an investor living through a recession, there’s always plenty that’s not clear, including its length and depth. There are also unknowns about whether further unexpected events could see the market move even lower.

What we do know is that recessions are often great opportunities for investors. With stock prices depressed, buying can improve the chances of gains when the markets correct.

In 2018, Buffett said, ‘The best chance to deploy capital is when things are down’.

The Pendulum

Famed investor Howard Marks often speaks about the market pendulum, and how it swings from the positive to the negative, then back to the positive.

The important thing is to be in the market when the pendulum does eventually swing back. Taking a ‘wait and see’ approach, can result in you missing the first five or so percentage points of the rebound.

One of the key takeaways from the chart, is that if you want to pick up the good returns seen after a recession, you must be in the market.

The InvestSMART Investment Committee does not try to predict upcoming economic events. Instead it focuses on creating diversified portfolios in line with the stated risk profile and recommended timeframe. Talk with the team today via the chat function in the bottom right-hand corner about our investment approach.

Frequently Asked Questions about this Article…

A recession is technically defined as two continuous quarters of negative GDP growth. It is also characterized by a significant and widespread downturn in economic activity that lasts for a sustained period.

Recessions typically occur every seven to ten years. However, in Australia, we have experienced slightly fewer recessions due to our resources sector and proximity to China.

During a recession, the stock market can have mixed results with ups and downs. On average, the S&P 500 has dropped 1% during past recessions, but it often makes significant gains after the recession ends.

Yes, recessions can be great opportunities for investors. With stock prices often depressed, buying during a recession can improve the chances of gains when the markets recover.

Warren Buffett said, 'The best chance to deploy capital is when things are down,' highlighting the potential benefits of investing during economic downturns.

The market pendulum, as described by Howard Marks, swings from positive to negative and back to positive. Being in the market when the pendulum swings back to positive is crucial for capturing good returns after a recession.

Staying invested during a recession is important because it allows you to benefit from the market rebound. A 'wait and see' approach might result in missing the initial gains when the market recovers.

InvestSMART focuses on creating diversified portfolios in line with the stated risk profile and recommended timeframe, rather than trying to predict upcoming economic events. They offer guidance through their chat function for personalized investment advice.