April enviro market update - STCs and LGCs

Small-scale Technology Certificates (STCs)

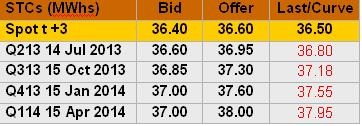

The incredibly consistent bull run across the first quarter of the calendar year, in which the spot STC market rallied almost 20 per cent in three months, finally come to an end in mid-April. But with the spot market sitting in the low $36s there is still plenty of speculation surrounding the future supply/demand outlook which is set to dictate pricing outcomes across the year.

As the first quarter of 2013 compliance entered its final weeks, the spot STC market managed to push beyond the $37 mark, reaching as high as $37.40 in early April. As can be seen in the spot price chart below it was a level not seen since early April 2011.

This very strong pricing outcome at such an early stage in the year came as a surprise to many, given that an accurate forecast of the number of STCs to be created in 2013 (the ‘base figure’ of the 2013 Small-scale Technology Percentage, STP) would only lead to a $40 pricing outcome occurring in early 2014 as part of fourth quarter compliance. Were this to occur, the worst case scenario would be for liable entities to purchase STCs from the clearing house in early 2014 at $40 for fourth quarter 2013 compliance.

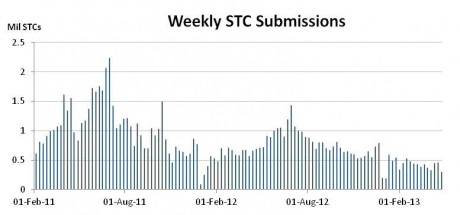

The strong pricing outcome has been ascribed to the considerable demand for STCs for first quarter surrender which, with its 35 per cent weighting, is the largest of the year. Once again, owing to exemptions under section 38 AF of the Renewable Energy (Electricity) Act, there were approximately 250,000 fewer STCs surrendered in the first quarter (12.24 million) compared with what would have been the case if 35 per cent (12.49 million) of the 2013 target (35.7 million) were acquitted (see chart above).

Interestingly, the difference between expected and actual surrender in the first quarter was lower in 2013 than in either of the previous years of the scheme’s operation, meaning liable entities have seen less change in their loads when compared to the previous year.

In recent weeks, the spot STC market has lost ground, trading consistently within a $36.00-$36.50 range, with several attempts at breaching the bottom end of that range having failed.

STC submissions to-date (including the two million that were pending registration as at December 31, 2012) have remained above what is required by the base figure (20.7 million) of the Small Scale Technology Percentage. Yet there are many factors which will influence the supply/demand balance across the year.

Of major note will be the continuing decline in the number of 2-times multiplier photovoltaic installations which have buoyed STC creations in the early part of this year. The potential for a mini boom of sorts in Queensland, as the cut off date (June 30) for the installation of PV systems which remain eligible for that state’s now expired 44 cent feed-in tariff, continues to be much discussed.

Also likely to be of interest is the level of sales and activity in the PV industry across winter, which has typically been a quieter period for the industry. One final factor impacting the supply side will be just how significant the growth in commercial PV installations proves to be across 2013.

While STC demand is notionally fixed, 2012 proved that a deviation between actual electricity demand and the estimate used as part of the STP calculation can have a material impact on the number of STCs surrendered. As shown in the last market update provided to Climate Spectator, the true-up of actual versus estimated electricity demand, which happened in the final quarter of 2012, led to 1.5 million fewer STCs being surrendered for the 2012 compliance year than was expected (43.15 million versus 44.79 million).

In a year in which electricity demand appears once again to be softening and in which the supply/demand balance at the end of the year may be calculated in the millions rather than the tens of millions, this may prove an important factor in determining whether the clearing house comes into play.

Large-scale Generation Certificate (LGCs)

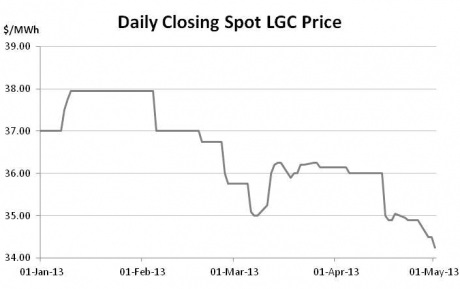

Held captive by a combination of a perennial sense of uncertainty and an ongoing short term oversupply, the LGC market remains characterised by gappy trading and, more recently, by softer prices.

Having begun the year stronger, trading just shy of the $38 in January, the spot LGC market remained with a $35-$37 for most of the subsequent three months. In recent weeks however the spot has softened through this level on its way to a 29 week low of $34.25.

To pinpoint a specific reason for this softness is difficult, although among the likely explanations is the fact that overall liquidity remains low owing to the ongoing oversupply and the absence of short term imperatives mong many buyers. Yet there is also the issue of the potential for regulatory change which has hung like a dark cloud over the market for several years now.

That the cloud remains is the result of the Coalition’s recent statements that it would revisit the Climate Change Authority’s Renewable Energy Target Review recommendations within six months of winning office. Several major industry participants continue to call for an alteration to the methodology for calculating the LGC target and the belief in some quarters is that the Coalition’s support for the RET may shift from being unequivocal to instead be conditional upon some alterations.

Perhaps unsurprisingly the forward market for LGCs has remained particularly quiet in recent months.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.