A war of words in wealth management and how it affects you

The finance industry is arguing with itself over two esoteric sounding but important issues which have the potential to confuse: the first is active versus passive investment management, the second is traditional versus outcome-based investing.*

BIG ISSUE ONE: ACTIVE VERSUS PASSIVE MANAGEMENT

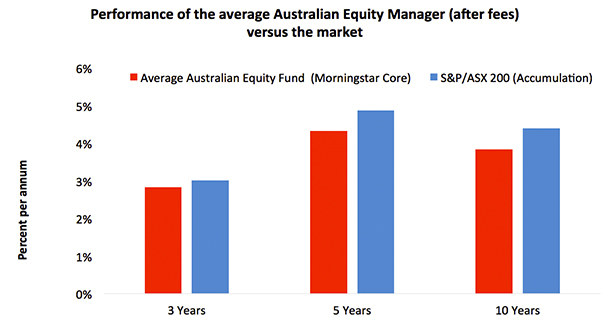

There is a wall of evidence that has been building over decades that the average active manager underperforms the benchmark, which for Australian equities is generally the S&P/ASX200.

It’s true. Google it yourself and you’ll find a wealth of evidence, especially overseas (where the benchmark will be different, of course).

The chart shows the experience in Australia where again the average mainstream manager has underperformed over the long term by an amount roughly equivalent to the fees charged, which is also what you would expect in theory. The better alternative is to use a passive index fund or an ETF, as we do with the InvestSMART portfolios.

Source: Morningstar

BIG ISSUE TWO: TRADITIONAL VERSUS OUTCOME-BASED INVESTING

By “traditional” investing we mean (in a nutshell) funds with different allocations to bonds and equities. There are some widely recognized “benchmark” allocations such as 70/30 (where 70% of funds is invested in bonds and 30% in equities), 50/50 or, the opposite, 30/70 (30% in bonds, etc).

The second approach, the “outcome-based” strategy, typically defines a returns objective such as beating the inflation rate or cash rate by a fixed percentage, and the starting point is working out what assets you need to invest in to reach that objective.

The “traditional” approach gives the comfort of knowing roughly where your assets are invested at a given point in time, but it is not a given that the mix will get you where need to go. A 70/30 split between bonds and equities doesn't actually mean anything in itself.

The outcome-based approach sounds more intuitive but it can be difficult to track where your assets are invested. Both approaches also tend to use mostly active managers, especially the outcome-based approach.

There is very little evidence that people are any good at predicting where those assets should be invested. However you do want someone making sure you avoid the obvious mistakes (emerging markets in 1998, dotcoms in 2000 and 2016?).

WHAT’S OUR TAKE ON ALL THIS?

We know active managers will underperform on average, and that’s why we mainly use index ETFs for these diversified products. But “dumb” indices don’t always give you the exposure you want, so you may need to use active fund managers if they offer a substantially different outcome.

A good example is with fixed interest bonds, where passive indices automatically allocate more capital to the most indebted governments and companies because they borrow the most! This doesn’t exactly make sense and, besides, such low yields are incompatible with most portfolio objectives.

At the moment fixed interest is the only asset class where we use an active manager, but that could change in the future.

A BIT OF BOTH

We don’t exactly have a crystal ball but we do think it is sensible to do one’s best to make sure portfolios are positioned in a way that gives you a reasonable chance of reaching objectives you can identify with and understand. The InvestSMART Diversified Portfolios therefore have outcome-based objectives (RBA cash rate plus X% over a specific number of years depending on the investor’s risk tolerance and investment time horizon) but much of the time they look quite similar to traditional funds.

COPY CATS

As we wrote about a few months ago you can replicate all the bells and whistles of a multibillion-dollar industry fund or traditional multi-manager fund with a handful of ETFs, although it’s another question entirely whether that is something you actually want to do.

We spend a lot of time working on forecasts of likely returns for the major asset classes and if necessary we will deviate substantially from the traditional peer group benchmarks. When we do that we will also try our best to tell you exactly what we are doing ahead of time — and why we are doing it.

* While we are on the subject of confusing, the team that manages the InvestSMART Diversified Portfolios (that’s us) has a hard-earned reputation for being techy and long-winded. This is partly because we are and partly, if you’ll allow a little defensiveness, it’s because we are often trying to bridge a gap between the technical clutter of a mature and over-complicated industry and the more relevant task in hand which is helping you manage and grow your wealth.

Frequently Asked Questions about this Article…

Active investment management involves fund managers making specific investment decisions to try and outperform a benchmark, while passive investment management aims to replicate the performance of a benchmark index, often through index funds or ETFs. Evidence suggests that active managers often underperform the benchmark, especially after accounting for fees.

Active managers tend to underperform because their fees can erode returns, and consistently beating the market is challenging. Passive strategies, like index funds or ETFs, typically have lower fees and aim to match market performance, which can lead to better long-term results for investors.

Passive index funds and ETFs offer lower fees, broad market exposure, and the potential for better long-term performance compared to actively managed funds. They are designed to track a specific index, providing a simple and cost-effective way to invest.

Traditional investing involves allocating funds between bonds and equities based on a set ratio, like 70/30. Outcome-based investing focuses on achieving specific financial goals, such as beating inflation by a certain percentage, and involves selecting assets that align with those objectives.

Outcome-based investing can be difficult to track because it requires selecting assets that align with specific financial goals. It often involves active management, which can lead to higher fees and the challenge of predicting the best asset allocation to achieve desired outcomes.

Investors might choose active management for fixed interest bonds because passive indices tend to allocate more capital to the most indebted entities, which may not align with portfolio objectives. Active managers can make more strategic decisions to avoid such pitfalls and potentially achieve better returns.

Yes, it's possible to replicate the features of a traditional multi-manager fund using a handful of ETFs. However, whether this approach suits your investment goals depends on your specific needs and preferences.

InvestSMART uses a combination of outcome-based objectives and passive strategies. Their diversified portfolios aim to achieve specific returns over time, often using index ETFs, but they may also employ active management when necessary to meet portfolio objectives.