A calm head will prevail

How the events in Ukraine play out is not for us to speculate, nor is it for us to try to counter with quick reactions because this event will, in time, pass.

Time is the keyword here – the old adage ‘time heals all’ is a cornerstone of investing. Time gives you that ability to transcend event shocks, even like the one we are seeing now. Think about the recoveries post the first global pandemic in 100 years, the Global Finance Crisis and all the other events that have impacted investment markets since creation.

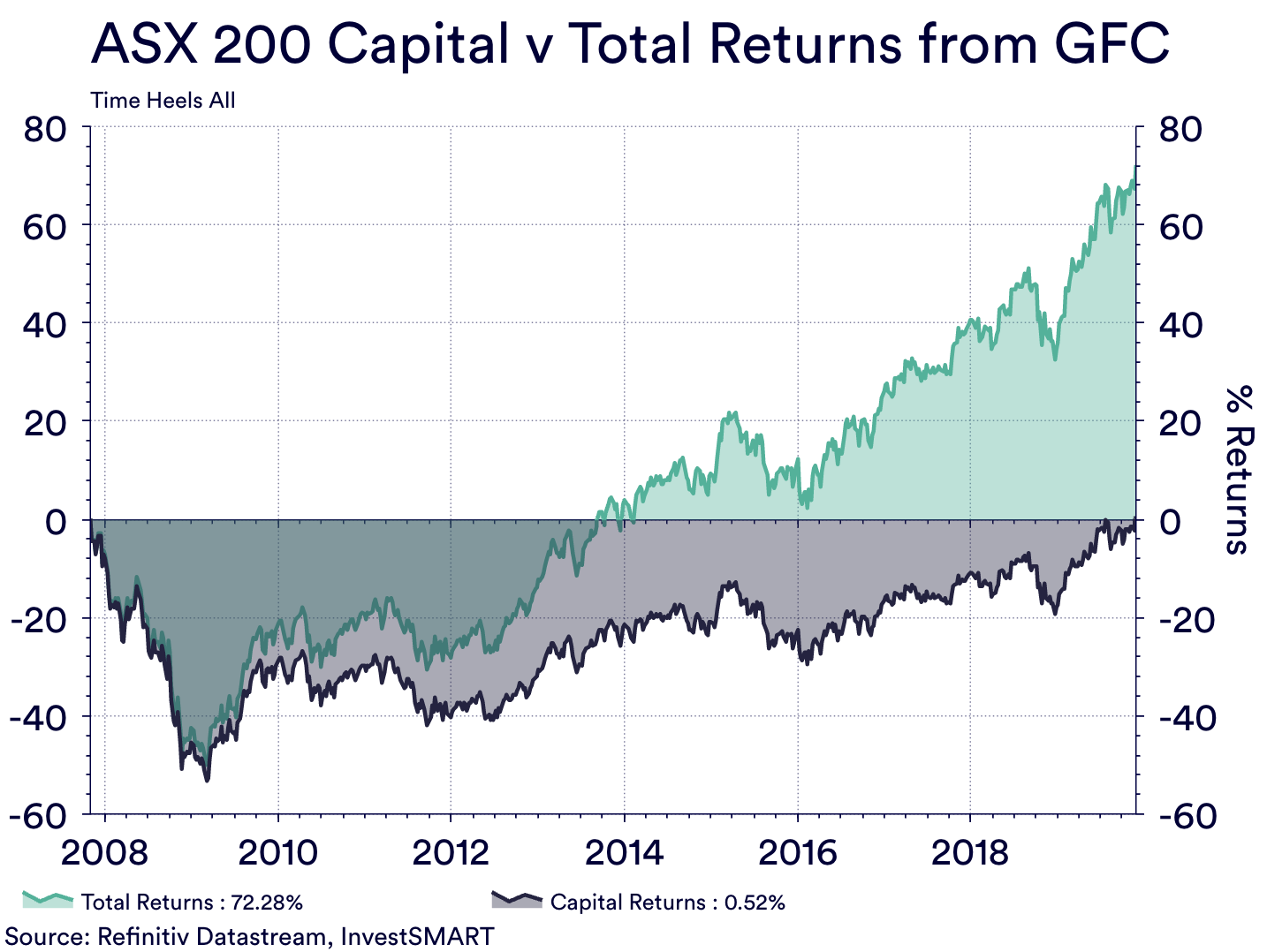

Here is the best way we can explain why time will heal all. Below is a chart of the ‘unluckiest investor’ leading into the Global Financial Crisis. This investor invested in the market at the very top on 1 November 2007. Their investment then fell 55 per cent in the next nine months.

However, if that investor stuck to their investing principles of reinvesting their dividends (total returns) and staying in the market for the long term, by 2013, they would have had recouped everything. If they continued on reinvesting until the market returned to the level reached on 1 November 2007 – that unlucky investor would have gained 72.3 per cent.

In the words of Howard Marks -"Why sell something you think has a positive long-term future to prepare for a dip you expect to be temporary?"

Not only that, if that unlucky investor had consistently added to their portfolio, they would have recouped their initial investment even faster. Moreover, they would have an even greater gain due to better average pricing and a largest capital base giving them greater dividends to reinvest.

We understand that right now is a troubling time – but time will show that this is just another event your investment will weather.

Here are some additional articles about how to deal with market volatility and geopolitical events that affect your investments.

Links

Buying when you feel like selling

How to manage market volatility

Free Webinar

Register now to watch Evan Lucas and Tom Wilson on the By the Numbers webinar.

Frequently Asked Questions about this Article…

Time is a powerful ally in investing. It allows you to transcend event shocks, such as market downturns, by giving your investments the opportunity to recover. Historical events like the Global Financial Crisis have shown that staying invested and reinvesting dividends can lead to significant gains over time.

During market volatility, it's important to stay calm and stick to your long-term investment strategy. Avoid making quick reactions to temporary dips. Instead, focus on reinvesting dividends and consider adding to your portfolio to take advantage of better average pricing.

Reinvesting dividends is crucial because it helps compound your returns over time. By reinvesting, you increase your capital base, which can lead to greater dividends in the future and accelerate your recovery from market downturns.

The 'unluckiest investor' who invested at the market peak before the Global Financial Crisis saw their investment fall by 55%. However, by sticking to their principles of reinvesting dividends and staying invested, they recouped their losses by 2013 and eventually gained 72.3%.

Howard Marks advises against selling investments during a temporary dip if you believe they have a positive long-term future. Selling in anticipation of a temporary downturn can prevent you from benefiting from future recoveries.

Adding to your portfolio during downturns can be beneficial because it allows you to purchase investments at lower prices, improving your average cost. This strategy can lead to faster recovery and greater gains when the market rebounds.

There are several resources available to help you manage market volatility, including articles on buying when you feel like selling, how to worry better, and managing market volatility. Additionally, you can register for webinars like 'By the Numbers' with experts Evan Lucas and Tom Wilson.

Maintaining a long-term investment perspective is important because it helps you weather temporary market events and focus on the potential for future growth. Historical recoveries from events like the Global Financial Crisis demonstrate the benefits of staying invested over time.