A Bumper Start for Crypto

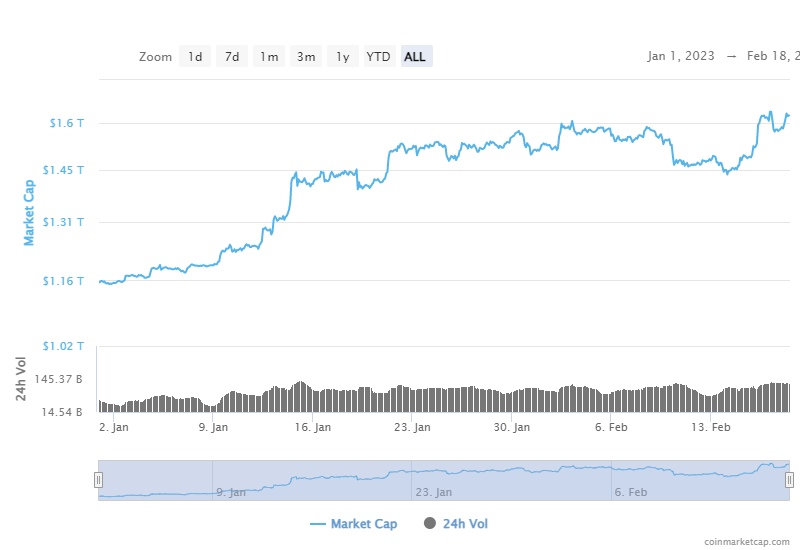

Crypto traders/investors have enjoyed a bumper start to 2023 with the entire crypto market cap rising 40 per cent so far this year. That’s a welcome change of fortune compared to 2022’s wipe-out. But given the prevailing macro conditions, shorter-term risks remain abundant.

Source: coinmarketcap.com

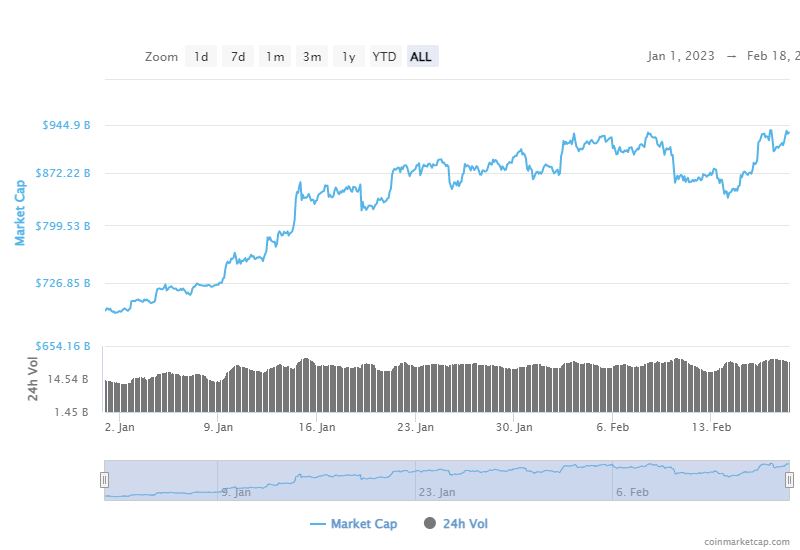

Excluding BTC but still including ETH (the Ethereum blockchain’s native token and the second-largest crypto by market value), the total market capitalization has risen 34 per cent since 1 January:

Source: coinmarketcap.com

BTC is trading at around $A35,800 as of writing, up 47 per cent year-to-date from $A24,300, although this is still 60 per cent down from its all-time-high of just under $A92,000 in late 2021:

Source: coinmarketcap.com

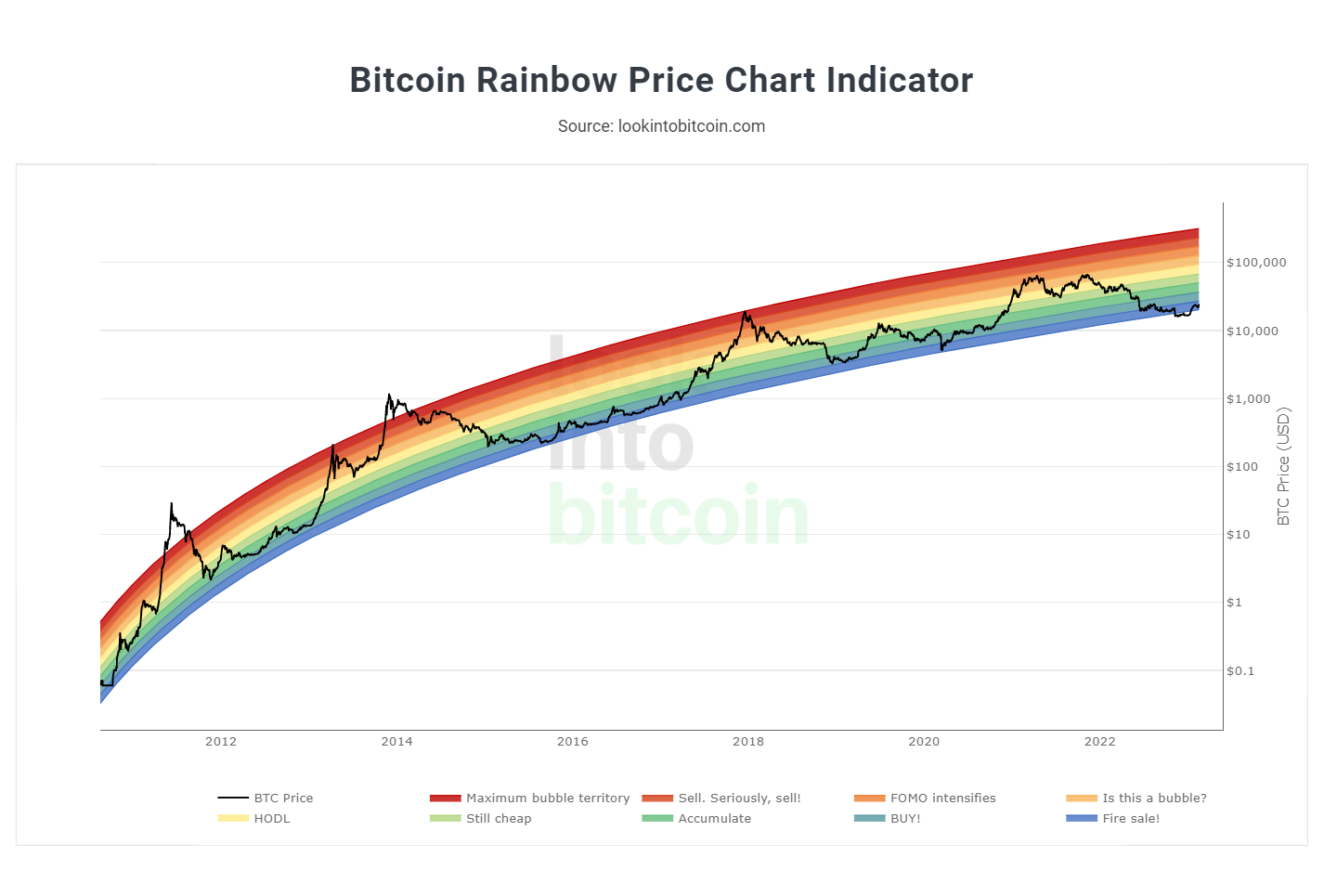

On a longer timeframe, BTC has risen back above its bottom logarithmic price channel and shows signs of potentially repeating its cyclic boom and bust price action over the medium term:

Source: www.lookintobitcoin.com

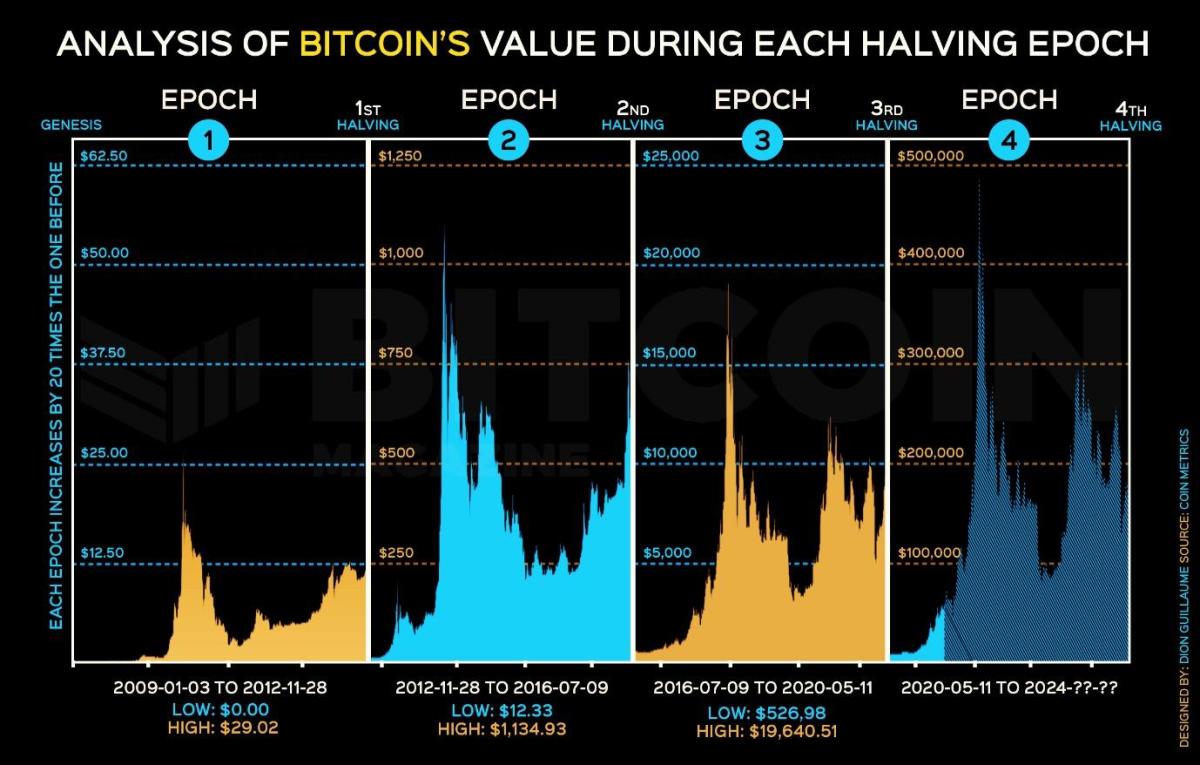

Bitcoin observers will be familiar with its halving cycle (where Bitcoin’s supply is cut in half roughly every four years). There have been three halving epochs since Bitcoin’s inception with BTC’s price exhibiting a similar behaviour during each cycle:

Source: bitcoinmagazine.com

Each halving cycle has seen broader and deeper adoption with price peaks and troughs significantly greater that the previous cycle. Some observers believe that the current macroeconomic conditions of rising inflation and interest rates may alter BTC’s price trajectory due to the reduction in market liquidity for risk assets. If the macroeconomic outlook doesn’t do the job, then regulatory crackdowns might.

Only time will tell how BTC price action, and the Bitcoin ecosystem at large respond to current conditions. But observers of history will know that Bitcoin, and the crypto market at large, have experienced market mood swings caused by myriad external factors and survived, if not thrived, into the next cycle.

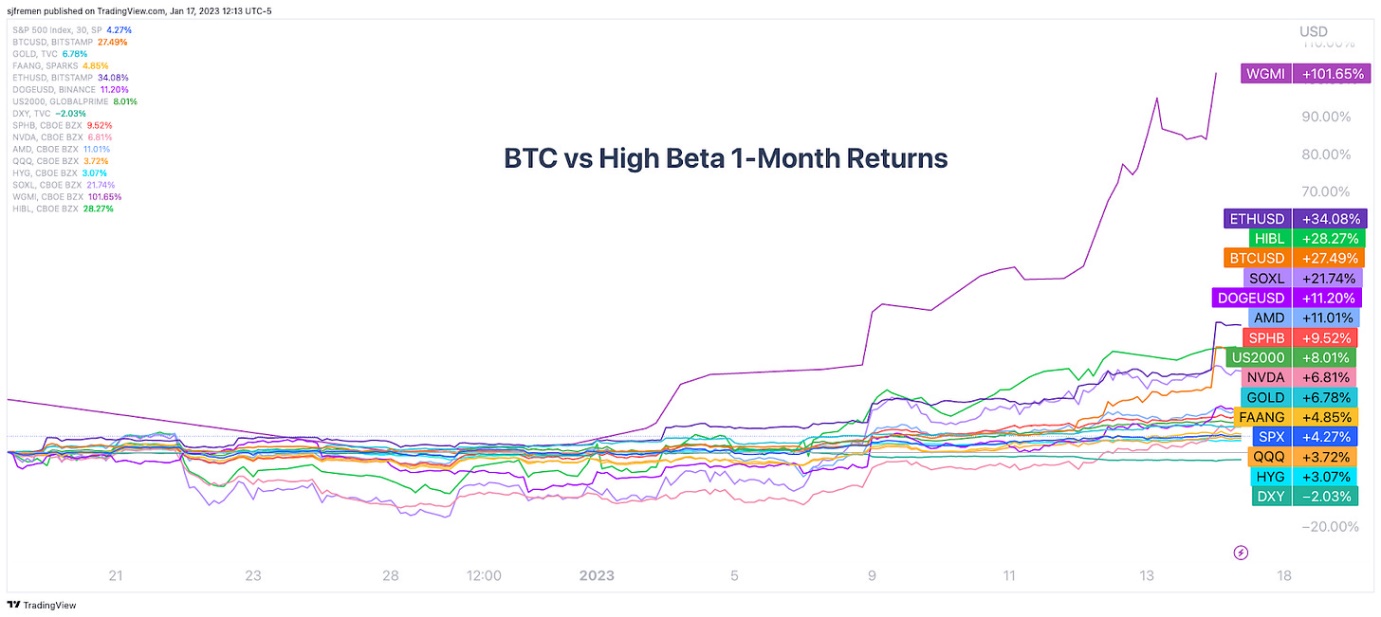

While crypto evangelists have often cited BTC and other crypto as offering hedges against other monetary assets, the reality is that crypto in general is a risk-on asset and correlated with other risk-on assets.

As equities have recently bounced, so has crypto. According to Bitcoin Magazine, several crypto tokens have risen sharply over the last month in line with broader rises in the S&P500, Nasdaq, FAANG stocks, and other tech stocks like AMD and NVIDIA. (The largest rise is the US WGMI ETF which has several Bitcoin miners in its portfolio). As the riskiest of risk-on assets, crypto has moved faster and further than equities as animal spirits returned in early 2023.

Source: bitcoinmagazine.com

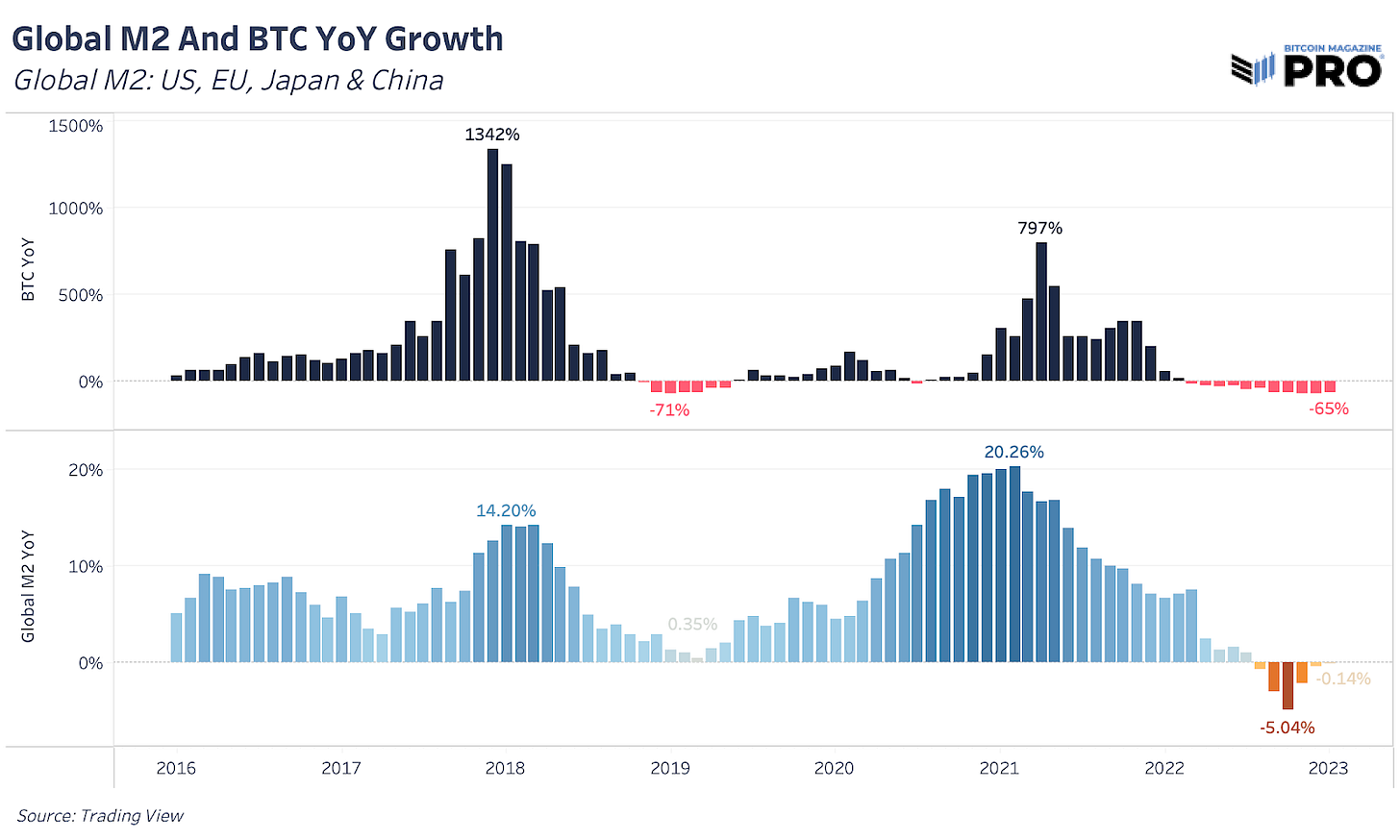

BTC also shows a consistent correlation with global M2 money supply (M2 being a measure of the money supply that includes cash, deposits, and other types of deposits that are readily convertible to cash). BTC’s price action has virtually mirrored that of global M2 over the last several years:

Source: bitcoinmagazine.com

Such historical correlation might be a pointer to BTC’s future price action should monetary expansion return.

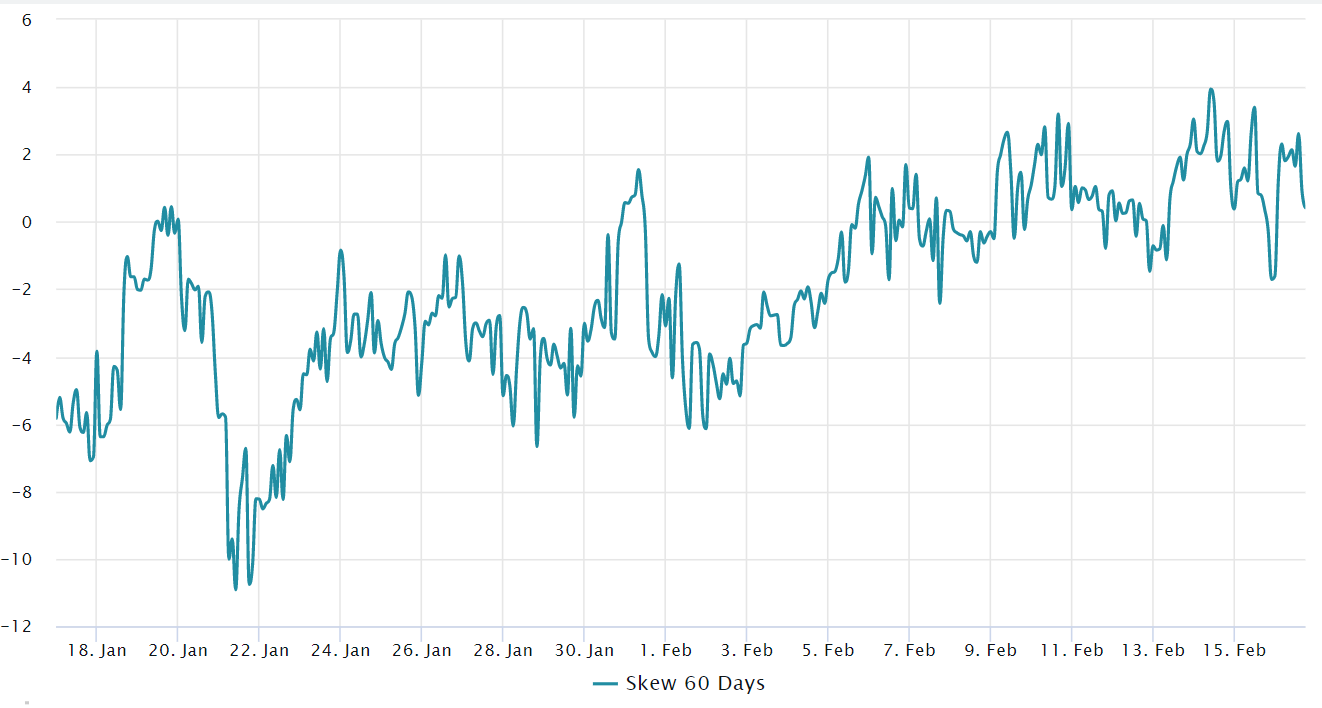

Market traders also consider the state of BTC derivative markets to get a feel for short-term sentiment. As an example, the ratio of BTC put options (the option to sell at an agreed price) to call options (the option to buy at an agreed price) provides an insight into the balance between fear and greed:

Source: laevitas.ch

As BTC’s price has sharply risen so far in 2023, the “put to call skew” has risen too but is presently close to neutral, suggesting a balance between fear and greed sentiment. A rising put skew may suggest a growing bearish sentiment, which may be a precursor to a price fall.

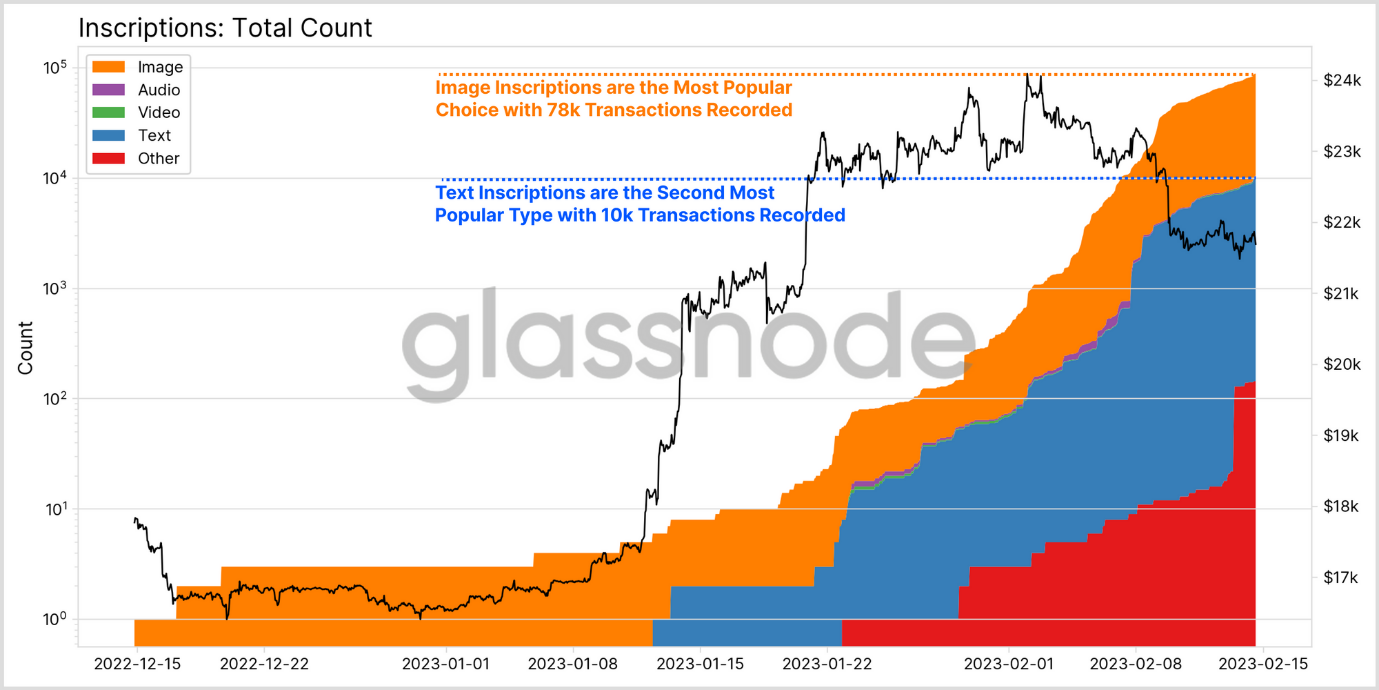

Smart investors taking a longer-term view will benefit from observing developments in the underlying technology that may impact future price action. A recent, somewhat controversial development of the Bitcoin ecosystem is the emergence of the so-called “Ordinal” protocol.

The Ordinal protocol enables anyone to inscribe data directly onto the Bitcoin blockchain, including data representing images, audio, video, text, or other content. The ability to encode digital content onto the Bitcoin blockchain effectively allows Bitcoin to compete with Ethereum and other blockchains as a platform for NFTs.

As of writing, almost 100,000 inscriptions have been encoded onto the Bitcoin blockchain, resulting in increased transaction congestion and competition for Bitcoin’s blockspace. It has also likely contributed to BTC’s rising price:

Source: insights.glassnode.com

“Ordinals” consume Bitcoin blockspace for purposes that diverge from Satoshi Nakamoto’s original vision, hence the debate. As with all emerging crypto use cases, only time will tell if the use case persists and drives adoption. Since BTC has a fixed supply, anything that drives adoption also likely drives up the BTC price.