Why your financial adviser loves ETFs

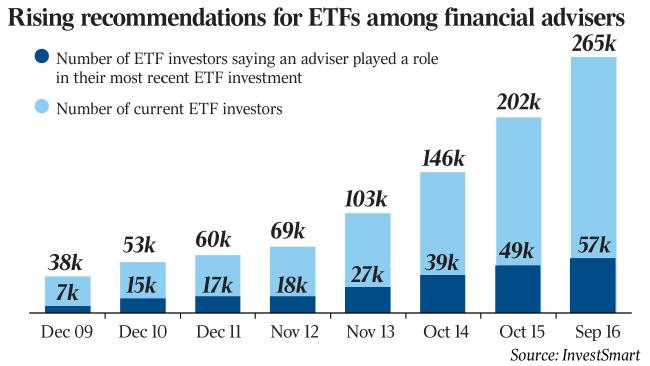

Rising recommendations for ETFs.

The next time you chat to a financial adviser about portfolio construction strategies, depending on your investment focus of course, the conversation could very well turn to the use of exchange-traded funds.

Advisers have become one of the core drivers behind Australia’s rapidly growing ETFs sector, which at the start of this month edged past $26.6 billion in total assets under management.

So far this calendar year about $1.2bn in new investor funds have been channelled into ASX-listed ETFs.

Research just released by research firm Investment Trends and ETFs issuer BetaShares shows seven out of 10 advisers are either currently recommending the use of ETFs to their clients or intend to do so in the future. And their survey found that almost 80 per cent of the 7500 advisers they surveyed, who invested new client money into direct listed equities during 2016, had used ETFs.

It’s compelling evidence that Australia’s ETFs market is on a strong growth trajectory, with product issuers reporting steady increases in funds flows. Financial services groups are also experiencing solid inflows of investor capital into tax-effective separately managed account platforms, which often use ETFs as the core part of their portfolio offerings.

So why are advisers actively recommending ETF-based equity strategies?

Ironically, a lot comes down to financial regulation and consumer protection. Australia’s financial advisory landscape changed markedly in 2012-13 when the federal government’s Future of Financial Advice legislation was passed. FoFA abolished the generous upfront, trail and soft commission structures that had, until then, been enjoyed by advisers who recommended their clients into managed fund products.

One of the other outcomes of FoFA was that, by having to document why they had recommended clients into specific products, the cost of compliance for advisers increased dramatically.

ETFs have proved highly effective for advisers on a costs level, because they are extremely cheap to buy into and require minimal administration input on their part.

The Investment Trends-BetaShares report shows that 94 per cent of advisers rate the low cost of ETFs as the top reason for using them, followed by their ability to direct clients into listed securities that offer a high level of diversification across markets and asset classes (77 per cent response).

Advisers also highly value the ability to easily buy and sell ETFs on market for their clients, the advantages of being able to invest into overseas markets such as the US using locally listed ETFs, and the ability to access specific asset classes through ETFs providing exposure to property, fixed interest and other sectors.

There’s also a degree of risk mitigation on the part of advisers in using ETFs because many of the ETF products available employ passive index-tracking strategies, meaning the clients who use them will achieve the market return minus management fees.

Offsetting this is the increased use of “smart beta” ETF products that use rules-based strategies to try to outperform market returns.

Arian Neiron, managing director of ETFs issuer VanEck, says his group has been witnessing a greater uptake of smart beta ETFs.

These funds structure their stock weightings not on price but according to fundamental multi-factor metrics such as a company’s sales, cash flow, book value and dividend payments in an effort to deliver better-than-market returns.

By reducing weightings in the most expensive stocks, which usually have a sizeable impact on the performance of an index, smart beta funds offer the promise of enhanced portfolio returns and reduced risk at a low to moderate cost.

A major report on smart beta indexing this year by FTSE Russell found that “the smart beta phenomenon has matured to the point that large numbers of asset owners now consider smart beta indexes to be an important part of the investing toolkit.”

“More advisers are understanding on a portfolio construction level how to de-risk portfolios using smart beta,” Neiron says.

Blow to managed funds

The Financial Planning Association of Australia’s head of policy, Ben Marsham, says ETFs clearly have a benefit over managed funds in terms of costs.

Marsham notes that many planners are using ETFs as the core component of their clients’ equity investment strategy, adding that from an administration point of view holding ETFs is much easier for advisers as they require a lot less paperwork.

Self-managed super fund software provider Class lists the iShares S&P 500 ETF and the iShares Global 100 ETF as the two most popular ETF products among SMSFs, followed by State Street’s SPDR S&P/ASX 200 Fund and the Vanguard All-World Ex-US Shares Index ETF.

Alex Zaika, head of wealth at iShares Australia, the biggest ETFs issuer in Australia and fully owned by BlackRock, the largest fund manager in the world, agrees that both aligned and independent financial advisers are leading the ETFs charge, along with stockbrokers.

As well as being totally transparent in terms of where they invest, ETFs costs are well below 0.5 per cent in many cases and, like shares, are easily tradeable.

“Advisers are allocating, on average, 17 per cent of their clients’ portfolios to ETFs, and that’s forecast to grow to 23 per cent by 2019,” Zaika says.

By requiring minimal administration, advisers are being freed up to spend more time on providing higher-level client services. “More of our products are being sold through separately managed accounts. Fund managers are using (SMAs) to offer a range of professionally managed portfolios. So it’s no surprise that more and more advisers are using them.”

The rate of growth in investors using ETFs soared 31 per cent in the 12 months to September 2016. And, with the total number of ETF investors projected to top 315,000 this year, from the 265,000 at the end of 2016, expect more new ETF products to hit the market.