Separately managed accounts: a disrupter moves centre stage

There’s a quiet, but surprisingly powerful, revolution taking place within Australia’s investments arena that is showing no signs of being quashed anytime soon.

The disrupter is an innovative form of financial product known as a separately managed account, or SMA.

Retail investors are loving them because of their flexibility, transparency and tax advantages, their low investment entry point, and their overall cost effectiveness compared with other products such as managed funds.

Another big plus for SMAs is that investors can direct their capital into different managed investment portfolios, which may be growth or income-focused, or even linked to international equities, based around their preferred investment allocations and time horizons. The proof is in the numbers, too, with data from the Institute of Managed Account Professionals (IMAP) released this month showing Australian investors now have close to $31 billion in managed account products.

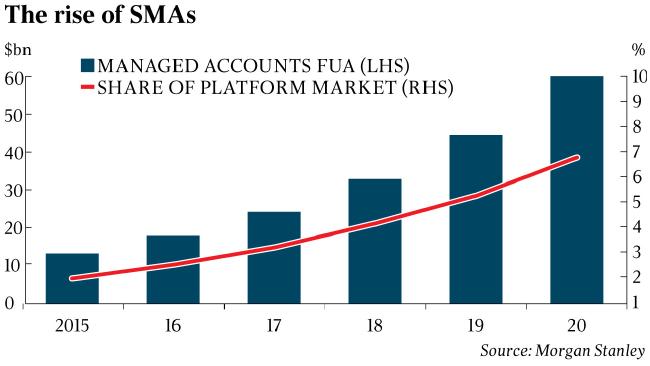

Investment bank Morgan Stanley has forecast that that figure will double to $60bn in the next four years, driven by strong investor demand, and aided by investment products providers, fund managers, financial advisers and new technology platforms.

So what are they …. and how do they work?

The product

In common with a managed fund, an SMA gives investors access to a diversified investment portfolio overseen by a professional investment manager. But unlike a managed fund, their investment isn’t pooled with money from other investors.

Through an SMA, an investor is the direct, beneficial owner of the shares and exchange-traded funds and other assets held within their account. Also, unlike a managed fund, an investor can easily see exactly what shares and securities they are holding, can monitor performance on a daily basis, and can exit their positions at will.

Of course the structure has some potential drawbacks: you may find yourself paying for shares on very high price earnings ratios, you may be limited to a selection of shares that are narrower than you might naturally choose and in some circumstances there may be tax changes.

However, many investors argue that those issues are more than compensated for by a structure that gives total control and transparency, and there’s also a major tax advantage in SMAs because they readily overcome the problem inherent in managed funds where the capital gains tax liabilities of all unitholders are shared. In an SMA, an investor can switch between portfolios without paying any tax penalty.

The day-to-day management of investments are taken care of, with a fund manager automatically rebalancing individual portfolios based on the individual investor’s strategy.

SMAs are also accessible to most investors, with some requiring a minimum investment of just $5000, and there are no platform or adviser fees, making them much cheaper than managed funds, which typically charge both plus management fees.

The story so far

The big paradox behind SMAs, of course, is that they’re not new at all. They have effectively been around as an investment structure since the 1990s. IMAP chairman Toby Potter describes them as “the overnight success story that’s been around 20 years in the making”. What’s given them new impetus are what Potter calls “a number of intersecting changes”.

“As the financial advice industry has matured, advice businesses have looked for suitable vehicles which allow them to articulate different investment philosophies in a cost-effective way for clients,” Potter says.

In its report, “Managed Accounts: Evolution or Revolution?”, Morgan Stanley says “the key headwind that delayed SMA adoption is SMSF growth, as they provided a tax-advantaged vehicle for high net worth clients.

“But this is turning into a tailwind as a more mature SMSF segment demands the benefits of SMAs — professional management with transparency, beneficial ownership and less tax leakage.”

All the way with SMAs

Jonathan Ramsay, director of portfolio construction and consulting company InvestSense, concurs, and notes: “SMAs are a product that represent a paradigm shift in wealth management, because they are a response to market, regulatory and technology forces.”

As well as many self-managed super fund trustees wanting more flexibility and control, Ramsay says SMAs are proving popular for financial planners wanting to build scalable business models in a heavily regulated market. Advisers can easily control and manage portfolios for many different clients while allowing clients to choose additional holdings should they wish, too.

Says Ramsay: “You can see what shares you own, the dividends, but importantly you can push the button and have the shares delivered to you and you can start managing yourself. Unlike a managed fund, you can’t get locked in, because you own the stocks in the first place. The technology wrapper allows someone else to trade on your behalf.”

Morgan Stanley says managed account structures such as SMAs are “a better customer mousetrap” because they meet more of their needs than managed funds.

“The better mousetrap is delivering higher flows and market share to progressive industry players — starting with financial planners,” it says. “Business models are realigning around the retail customer, not the product manufacturer — inverting the wealth value chain and driving a disruptive revolution in Australian wealth and asset management.”