Real-time insights critical for robo-advisers

The provision of timely information and timely advice was key to being successful in the realm of automated advice solutions as new entrants continued to emerge, according to InvestSmart.

Speaking to financial observer, InvestSmart chief executive Ron Hodge said the growing momentum behind automated advice in Australia was prompted by the fact it had the potential to be a convenient and low-cost option, delivering insights to clients in real time.

“What a financial adviser does is actually all about communication and [at InvestSmart] we don’t think robo-advice should be just about the product,” Hodge said. “We concentrate more on the advice part.

It’s ‘robo-communication’, communicating with the masses in a timely fashion to give them advice, news and research tailored to their needs.”

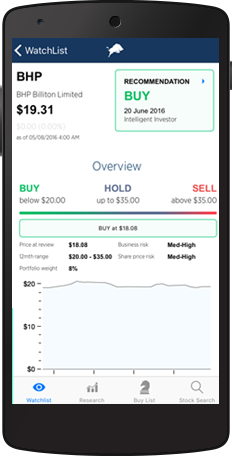

The comments follow the launch last month of InvestSmart’s robo-advice mobile app, which is an extension of the group’s existing digital advice service.

It allows users to combine InvestSmart’s portfolio management tools with stock recommendations and analysis from equities analysts at its sister company, Intelligent Investor, together with broader wealth management advice from the Eureka Report.

Users received instant notifications on stock recommendations, a feature Hodge said was important for driving engagement and had helped InvestSmart grow its user base to 700,000 registered users with $1.5 billion in funds under management.

“We know from our extensive database that there is very strong demand for mobile automated investment advice … [investors] want integrated tools so they can access all the information they need from one central place,” he said.

“The problem is that the majority of Australians don’t have the balances to pay for traditional financial advice … but we are not a threat to financial planners, we complement them.”

He noted cost and negative publicity as the two primary reasons behind the current low take-up of personal financial advice among Australians.

“There’s been a lot of blow-ups in financial advice over the last few years – just look at Storm Financial, CommInsure, Macquarie Bank – financial advisers haven’t exactly been painted in a good light,” he said.

“The other problem is that FOFA (Future of Financial Advice) has made personal, specific financial advice very expensive to everyday Australians.”

Digital advice remained a key step to addressing that problem, he said, as it presented advisers with a new form of client engagement for unadvised investors.

“We believe the new era of digital personal financial advice is not on the horizon but already here and firmly entrenched,” he said. “We need to get out there and give general advice in a much more affordable and timely way.”

(Click to get the InvestSMART App)

Frequently Asked Questions about this Article…

Robo-advice is an automated investment service that provides timely financial insights and advice. It benefits everyday investors by offering a convenient and low-cost option to receive real-time stock recommendations and wealth management advice, making investing more accessible.

InvestSmart's robo-advice app enhances investment decisions by combining portfolio management tools with stock recommendations and analysis from Intelligent Investor. It also provides broader wealth management advice, ensuring investors have all the information they need in one place.

Real-time information is crucial for robo-advisers because it allows investors to receive instant notifications on stock recommendations and market insights. This timely communication helps investors make informed decisions quickly, which is essential in the fast-paced world of investing.

Robo-advice is not meant to replace traditional financial advisers but to complement them. It provides a more affordable and accessible option for those who may not have the balances to pay for traditional advice, while still offering valuable insights and recommendations.

Australians face challenges with traditional financial advice due to high costs and negative publicity from past financial scandals. These factors have led to a low uptake of personal financial advice, making affordable digital solutions like robo-advice more appealing.

InvestSmart ensures its robo-advice is tailored to individual needs by focusing on 'robo-communication.' This approach involves delivering advice, news, and research that are specifically tailored to the needs of each investor, enhancing the personalization of the service.

The InvestSmart app plays a significant role in the digital advice landscape by providing a centralized platform where investors can access integrated tools, stock recommendations, and wealth management advice. This makes it easier for investors to manage their portfolios and stay informed.

Digital advice is considered a key step for unadvised investors because it offers a new form of client engagement that is both affordable and timely. It allows investors who may not have access to traditional advice to receive valuable insights and make informed investment decisions.