Investments: Fees fight starts to make a difference

Investing 101 is all about knowing what you’re buying — understanding the asset, its track record and the variables that will determine its overall performance.

It’s not rocket science, you may say, and if you’re buying into a financial product such as a managed share fund, an exchange-traded fund or a listed investment company, there’s not much else to know, is there?

To think so would be a dangerous assumption, and many investors continue to miss the big beast in the room that can quickly gobble up gross investment returns — product management fees.

Moreover, in a relatively low-return environment such as the one we are experiencing now, the level of overall fees being charged by some product issuers are doing just that.

Indeed, investors are being hit with ongoing annual product management fees of 2 per cent or higher on some products, equal to roughly a third of their total gross return.

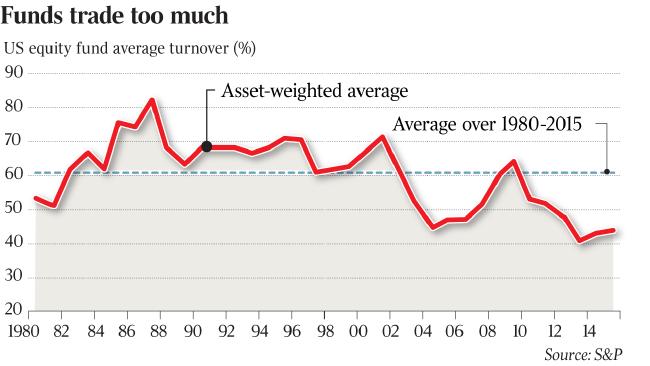

What’s worse is that the highest management fees being charged are by the actively managed investments funds whose primary mandate is to outperform against their market benchmark. In most cases, they haven’t.

A recent report from S&P Dow Jones Indices found that of 608 Australian actively managed equity funds benchmarked against the S&P/ASX 200 Index, 60 per cent actually underperformed the index in the year to June 30. Over three years, 66 per cent of managers underperformed, and over five years 69 per cent failed to make the grade.

The S&P Indices Versus Active Scorecard (SPIVA) also found that 81 per cent of 294 active managers had underperformed the S&P Developed Ex-Australia Large-Midcap index in the last financial year, and 89 per cent of 66 active managers had underperformed against the S&P/ASX Australian Fixed Interest Index.

Underperformance

Why have actively managed funds underperformed?

Just ask Warren Buffett, the billionaire US investor who famously bet $US1 million in 2008 against asset management firm Protege Partners over whether a fund that invested purely in the S&P 500 Index could outperform five different actively managed funds. So far, Buffett’s 10-year wager is massively ahead, with the S&P 500 Index up more than 70 per cent compared with returns of less than half of that by the chosen hedge funds.

But the hedge funds always have had extra lead in their saddlebags, with their investment performance being eroded by average annual fees of 2 per cent. On top of those, the funds are able to levy a 20 per cent index outperformance fee. By contrast, Buffett’s chosen fund has a flat annual fee of only 0.05 per cent.

In Australia, according to S&P Dow Jones Indices, the average management fee being charged by active equity managers is 1.24 per cent per annum, versus just 0.33 per cent by passive funds that simply track the Australian market.

Listed investment companies, which invest in a basket of stocks, have slightly cheaper fees — averaging about 90 basis points ($90 for every $1000 invested), while the average expense ratio of Australian exchange-traded funds is half again at about 45 basis points.

That’s because the majority of ASX-listed ETFs are passive index-tracking funds, essentially requiring far less human effort than an active fund that draws on the investment analysis of professional stock pickers.

Competition hots up

In a highly congested and competitive financial products market, the quest by issuers to lower their management expense ratios (MERs) has intensified.

On top of internal management fees and costs, the components of an MER can include everything from platform access fees to brokerage, accounting and legal fees, and other external costs including listing and registry charges. Many product issuers are tackling both, to win a larger slice of the investments pie.

As well as seeking to drive down their external costs, larger product issuers are also using their financial scale based on funds under management as a lever to cut their own fees.

That’s showing up in the data, too. A separate report compiled by Morningstar with the Financial Services Council, released in July, shows that the median fees being charged by Australian product issuers have been trending down over across all major asset classes.

Surprisingly, the report also found that Australian product fees were among the lowest in the world, even the US.

“These results, comprising data from some of the world’s largest fund managers, show that investment management fees charged in Australia are among the world’s lowest (if not the lowest),” Morningstar said.

“Anecdotally, the FSC heard from several fund managers that on most occasions, approval had to be sought on a regular basis from head office to lower the fees charged in Australia in order to win business.”

Vanguard head of market strategy and communications, Robin Bowerman, says that at the most basic level, lower fees mean the investor gets to keep more of the return.

“You can’t control future performance, but you can control costs,” Bowerman says. “In this low-return environment, we are certainly seeing some price competition. The cost of investing has been brought down to very low levels.”

The head of strategy and marketing at ETFs issuer BetaShares, Ilan Israelstam, adds that lower MERs are one of the primary reasons behind the success of ETFs.

“Nobody is going to argue about ETFs being cheaper. ETFs are either rules based or passive, and if you don’t have to hire fund managers you can achieve lower costs that way,” Israelstam says.

For investors, fees transparency is key, and it’s not always there. In ETFs and LICs, fees are invariably built into a security’s on-market trading price. In managed funds, they are easier to discern by virtue of a fund’s product disclosure statement.

But behind the scenes, the launch of new products including ETFs, and the increasing use of index-style products, are putting pressure on fees. Active fund managers are being held to account.

“This is an industry where you get what you don’t pay for — if you’re paying fees to outperform the market, you’re likely to be disappointed,” Bowerman says.