Harnessing volatility can actually improve retirement returns

Traders on the floor of the New York Stock Exchange.

The spectre of inflation and accelerated interest rate rises are firmly back on the economic agenda, and that means market volatility is back with a vengeance. That’s a reality that all investors, of all creeds, should take on board.

Active traders and value-seeking fund managers actually enjoy volatility, because they can buy undervalued stocks during the market dips and sell them on the rebounds. On the other hand, retail investors — especially those in or nearing retirement — hate it.

And that’s where there are increasing calls for superannuation funds and other fund product providers to use financial derivatives such as options and futures to help smooth out volatility for investors wanting more portfolio stability.

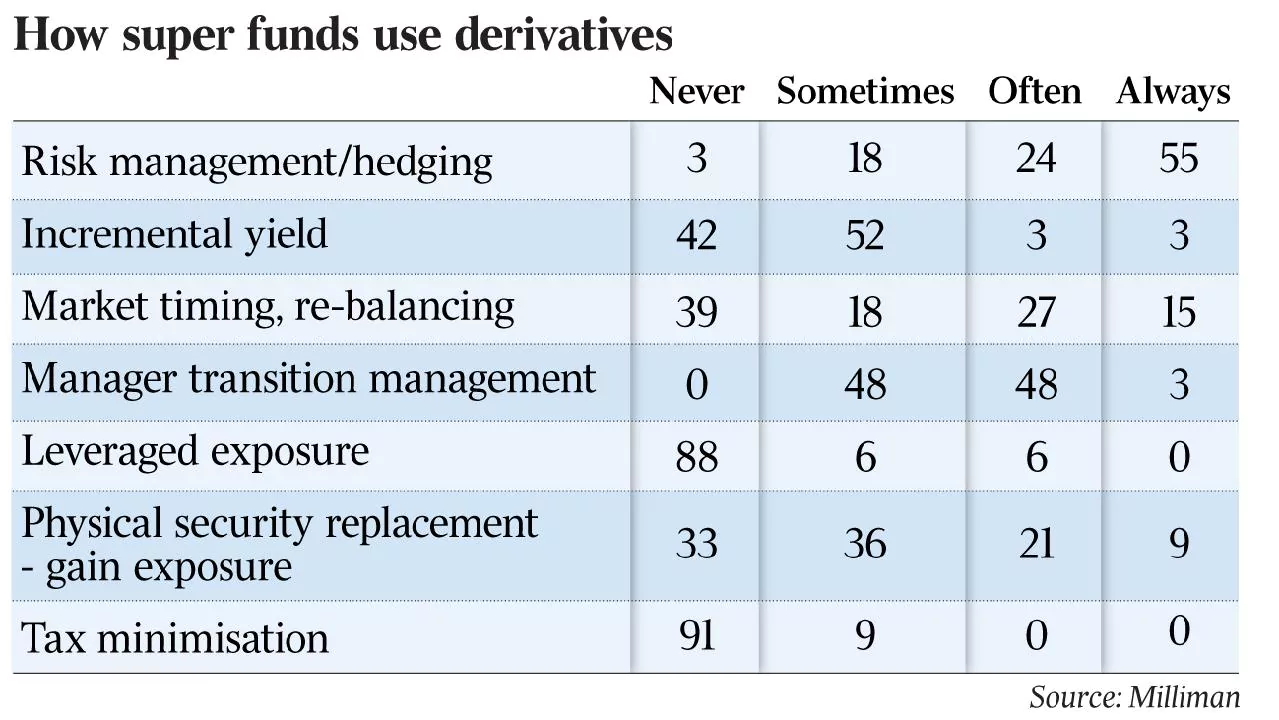

A report released last month by actuarial consultants Milliman Ltd around the use of derivatives by Australian superannuation funds to protect against sharp market downturns is quite timely.

It found that just over a third (37 per cent) of super funds’ pension products employ derivatives to protect retirees against market downturns. While most of them use derivatives across their accumulation products, it seems that the costs of buying market protection is an obstacle. Respondents to Milliman’s survey also raised concerns about the effectiveness of using derivatives for risk management and tail risk hedging, as opposed to simple diversification.

Report author Michael Armitage, head of fund advisory services for Milliman, says there is definitely scope to broaden the use of financial instruments that offer greater investment protection to retirees.

“It represents an opportunity given funds must meet the demands of retiring baby boomers who are living longer but face historic low returns from defensive assets,” Armitage says. “In many cases, risk averse retirees need to take on more investment risk but cannot bear volatility or market crashes as they drawdown on a lifetime of savings.”

More than half (53 per cent) of super funds surveyed said that the cost of using derivatives for downside risk management and tail risk hedging was too high, according to the Milliman survey.

Armitage says this is likely to change because “those funds in the industry that seek to be in the business of retirement and not just accumulation recognise the unique goals and needs of older Australians”.

Chad Padowitz, chief investment officer at Wingate Asset Management, says derivatives strategies can deliver enhanced returns for investors during times of volatility.

“We use options in our investment process, but we use them in a manner that allows us to implement a portfolio and get paid for taking the risk.

“Volatility allows you to buy different shares you otherwise wouldn’t have bought, better quality shares potentially. So we see volatility as the fuel for our returns. We ultimately get returns from a bottom-up stock selection process, but in terms of what drives the income component it’s the volatility.”

Harnessing volatility

Simon Ho, managing partner at the Grant Samuel Funds Management offshoot Triple 3 Partners, says volatility has emerged as a distinct asset class in recent years, and it offers a largely untapped source of outperformance for investors’ portfolios. “With low correlation to other asset classes, volatility can be used to enhance returns and manage risk, and can be accessed through the VIX Index with the use of options and volatility derivatives.”

The VIX Index is a measure of expected volatility on the S&P 500 Index over the next 30 days. High VIX readings mean investors see significant risk that the market will move sharply, either up or down.

Ho says the level of volatility tends to be negatively correlated to equity indices, indicating that when equity markets fall, volatility tends to rise and vice versa.

“Options on the VIX Index allow investors to access this feature, which cannot be as reliably harnessed in other asset classes, making VIX an ideally suited instrument for targeting returns that are negatively correlated to the S&P 500.

“Because the volatility inherent in options markets is negatively correlated to traditional assets, it is possible to hedge out the risk of holding equities via options on the VIX Index.”

With negative correlation to equities — and most other asset classes — volatility can be used to enhance returns, manage risk and potentially provide an additional source of alpha to a portfolio.

While the fees on using some derivatives strategies can have a compounding impact on long-term returns, Armitage says the real question is whether they provide a greater benefit than their cost.

“This can only be judged through the prism of members’ goals, which is shaped by super’s underlying purpose.”

Armitage says that Australia’s $2.3 trillion superannuation sector has been built with an accumulation mindset, with the focus clearly on increasing contributions and chasing high investment returns.

Yet, with an ageing population and more federal government obstacles in place aimed at reducing access to either a full or partial age pension, including recent changes to the assets test, the challenge for investors is to make their accumulated funds last as long as possible through retirement.

As such, it’s evident that more superannuation and pension product providers will need to keep adapting their offerings through products that use derivatives to manage market risks and that can provide a steady source of income in retirement.

Traders on the floor of the New York Stock Exchange.

Frequently Asked Questions about this Article…

Market volatility can significantly impact retirement investments by causing fluctuations in asset values. For retirees or those nearing retirement, this can be concerning as they rely on stable returns. However, some strategies, like using derivatives, can help manage this volatility and potentially improve returns.

Derivatives are financial instruments like options and futures that derive their value from underlying assets. They can be used to hedge against market downturns, providing a way to manage investment risk and stabilize returns, especially in volatile markets.

Some superannuation funds use derivatives in retirement products to protect against sharp market downturns. This approach helps in managing downside risk and tail risk, offering retirees more stability in their investment portfolios.

While derivatives can offer protection against market volatility, they come with costs that can impact long-term returns. It's important to weigh these costs against the potential benefits to determine if they align with your retirement goals.

Volatility has emerged as a distinct asset class that can enhance investment returns due to its low correlation with other asset classes. By using instruments like the VIX Index, investors can potentially achieve outperformance and manage risk in their portfolios.

The VIX Index measures expected volatility on the S&P 500 Index over the next 30 days. High VIX readings indicate significant market risk. Investors use options on the VIX Index to hedge against equity market risks and potentially enhance returns.

With an ageing population and changes in government policies affecting pensions, it's crucial for superannuation funds to adapt their offerings. This includes using derivatives to manage market risks and provide a steady income source for retirees.

Yes, active traders and fund managers often see volatility as an opportunity. They can buy undervalued stocks during market dips and sell them during rebounds, potentially enhancing returns through strategic stock selection.