Following the money trail in exchange-traded funds

Australia’s exchange-traded funds market is surging towards the 2016 finish line at a blistering pace, with net capital inflows in October topping $600 million.

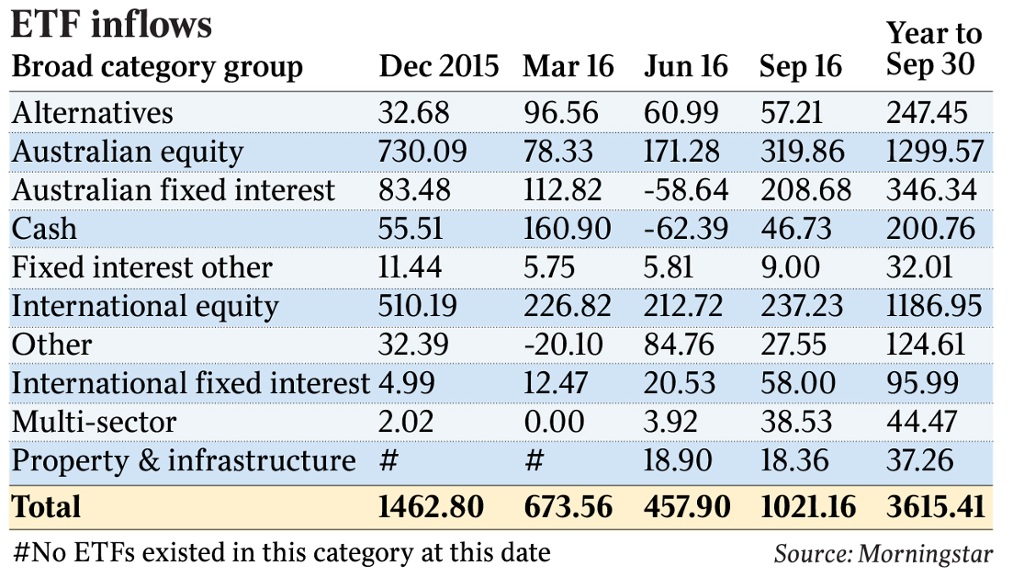

At this point, total inflows in the current quarter are on track to easily surpass the $1.02 billion of investor funds that flowed into the 150 or so ETFs listed on the Australian Securities Exchange during the three months to the end of September.

So, if all goes according to plan — for the ETF product issuers, that is — the total inflow of funds into Australian-listed ETFs for 2016 should be in the vicinity of $5bn, and potentially more.

This bumper year should push total funds under management across the ETFs space beyond the current $24bn level, further demonstrating the ongoing attraction of these products for investors.

Behind that attraction, of course, is the reality that ETFs are a low-cost entry point for those wanting exposure to whole market indices or asset classes through a single security, and they provide the in-built flexibility to buy and sell on-market at will because they are listed, as opposed to unlisted managed funds.

The trading volumes from the ASX show that the 12-month average number of monthly ETF transactions reached 63,843 in September, and the average value of monthly transactions for the 12 months to September hit $1.89bn.

Two clear patterns

That ETFs are a popular choice for retail investors is undisputed, and the rapid growth in the number of products available in Australia is testament to that. But what’s most interesting around the latest ETF inflows is where investors’ money is actually going.

There are two clear patterns in the data flows.

• While home-market bias is still evident, with investor inflows into products providing exposure to the broad Australian market remaining strong, the dollar inflows into international equity ETFs are also robust.

In fact, over the year to date, inflows into internationally focused ETFs have been higher, totalling $870m compared with about $840m for Australian-focused ETFs.

The bulk of the money continues to be channelled into ETF equities products, covering the ASX 200 index, the US S&P 500, and the MSCI World Index of the largest developed markets.

• There has been an acceleration in the “hunt for yield” — quite likely a reflection of low interest rates and an increased demand from those in retirement phase wanting better returns to generate regular income.

Supporting this, the BetaShares Australian Dividend Harvester — providing investors with exposure to large capitalisation Australian shares and franked dividend income, paid monthly — was the biggest puller in terms of equities funds in the September quarter. According to Morningstar, the ETF attracted inflows of $94.2m, compared with $51.5m in the June period.

It was followed by the Vanguard Australian Shares Index ETF and Magellan Global Equities Fund, each taking in about $83m in fresh shareholder capital.

Yield hunters

The fast-growing pool of funds now being directed into fixed interest ETFs reflects a renewed focus by investors on capital protection against their exposure to expensive equity markets, with many recognising the opportunity to chase higher yields in bond ETF products as interest rates begin to rise in the US and other parts of the world.

It is also an indication that more investors are recognising the benefits of products that offer higher real returns and greater flexibility than standard bank income products like term deposits.

Figures from the three months to the end of September show a strong uplift in inflows into Australian and international fixed-interest products. From a net outflow position of close to $60m in the June quarter, the investor tide into Australian fixed-interest ETFs turned completely in the September period to show positive inflows of more than $200m. Likewise, inflows into international fixed-interest ETFs tripled from $21m in the June quarter to about $60m in the three months to the end of September.

That trend was well reflected in the Australian ETF numbers, with the biggest fund inflows overall in the September quarter — just under $124m — going into the Vanguard Australian Fixed Interest ETF.

A further $46.7m was directed into the BetaShares Australian High Interest Cash ETF, which aims to generate returns above the 30-day bank bill swap rate and provide monthly income distributions. The fund has achieved this key objective ever since it was launched in 2012.

Over the year to date, inflows into fixed income ETFs have been just shy of $500m, compared with $440m in 2015.

“Fixed-income products continue to attract considerable investment, with 22 per cent of total ETF flows going into domestic fixed-income products and 5.5 per cent into international fixed-income products,” ANZ noted in its latest ETFs report. “The inflows into international fixed-income ETFs are of particular note, as this was the last key asset class made available to Australian ETF investors. There are only five ETFs in this asset class which have all been open to investors for less than a year (all five were launched in December 2015), pointing to strong demand for international fixed-income exposure.”

In the bigger scheme of behavioural investment patterns, the fixed-interest uplift is simply part of the ongoing evolution of the ETFs sector. It also reflects the continued diversification of ETF holdings by investors, especially into international products and other asset classes to reduce risk.