Drip feed: how reinvesting your cash dividends pays off

The following article, written by Eureka Report Editor Tony Kaye, was published in the Australian on October 16, 2018.

Australian shareholders have collectively raked in more than $35 billion in cash dividends from the latest earnings season, further swelling the bank accounts of millions of investors who are not registered for dividend reinvestment plans.

The bulk of the dividends ($28.5bn) came from the top 200 companies on the ASX, with the total dividend payouts to investors from the financial year to June 30 up about 8 per cent on the same period last year.

That’s great news for investors, but what should you do with these bumper returns? Sure, the sharemarket is volatile and last week’s sharp pullback would have rattled more than a few observers, but unless you have a specific reason to be cashed up, reinvesting dividend windfalls back into higher-earning asset classes is the most sensible investment strategy.

This comes back to individual portfolio construction and diversification strategies, and may include reinvesting back into the stocks or exchange-traded funds that generated the dividends in the first place. Another option is to amalgamate the cash received and invest that into different types of assets you don’t already hold.

While it is prudent to keep a proportion of one’s investment funds in cash for liquidity purposes, keep in mind that cash returns have been extremely low for most of the past decade and are unlikely to rise anytime soon in the current low interest rate environment.

Over the past decade, the base return from cash has been less than 3 per cent, compared to substantially higher returns from Australian and international equities.

Despite this reality, according to data from the Australian Prudential Regulation Authority, the amount of money sitting in low-interest bank savings accounts at the four largest banks (ANZ, Commonwealth Bank, NAB and Westpac) still totalled a massive $713bn at the end of July.

Including other authorised deposit-taking institutions, such as regional banks, building societies and credit unions, the total is more than $900bn. Most of this cash hoard is earning less than 2 per cent a year, and on average these savings accounts are paying basement level interest rate returns of just a fraction of 1 per cent on balances below $10,000.

The big banks and other institutions are holding off on raising their deposit account rates, even though they have been slowly ratcheting up their mortgage rates and are still deriving large returns from high credit card fees.

While much of that cash represents “at-call” money primarily used to fund living costs, there is also a large swag of investment capital locked into these types of savings accounts.

In fact, tax office data shows self-managed superannuation fund trustees are holding about $174bn of cash in their bank accounts, which includes products such as term deposits.

In summary, cash as an investment allocation is still accounting for about 24 per cent of total SMSF assets, and that is a strong indication that most self-managed funds are not sufficiently diversified.

Power of DRIPS

Holding money in a savings account will generate some level of return over time, even after bank fees and income taxes have been deducted. Naturally, the higher the amount of cash the higher the compounding return.

But the added power of reinvesting dividends is the ability to redeploy cash into an asset that most likely will not only generate a higher yield than cash, but which also has the potential for capital appreciation in the form of share price growth.

This effectively provides two potential sources for capital growth over time: income from share price increases in companies’ actual shares and from the dividends paid against each of the shares being held.

This is where dividend reinvestment plans (also known as DRIPs) are particularly beneficial, and hundreds of Australian-listed companies now offer them as an option to all shareholders.

DRIPs enable investors to reinvest the equivalent value of their cash dividends into new shares at no additional brokerage cost and, depending on market conditions, these shares are often issued at a discount to the prevailing trading price.

Over time, investors using a DRIP can save a substantial amount on brokerage fees while building up a larger company shareholding, which will compound as more shares are added.

Yet, there are some tax considerations. The tax office deems that those who participate in a dividend reinvestment plan are treated for capital gains tax purposes as if they had received a cash dividend and then used the cash to buy additional shares.

Each new share is subject to CGT, which for accounting purposes means that investors need to keep a record of the price their new shares were issued at, separate to the transaction record detailing their original buy-in price.

Another consideration around the DRIP strategy is that by locking into a company’s reinvestment program, investors are putting their dividend returns at a greater risk than simply diverting the cash into a savings account.

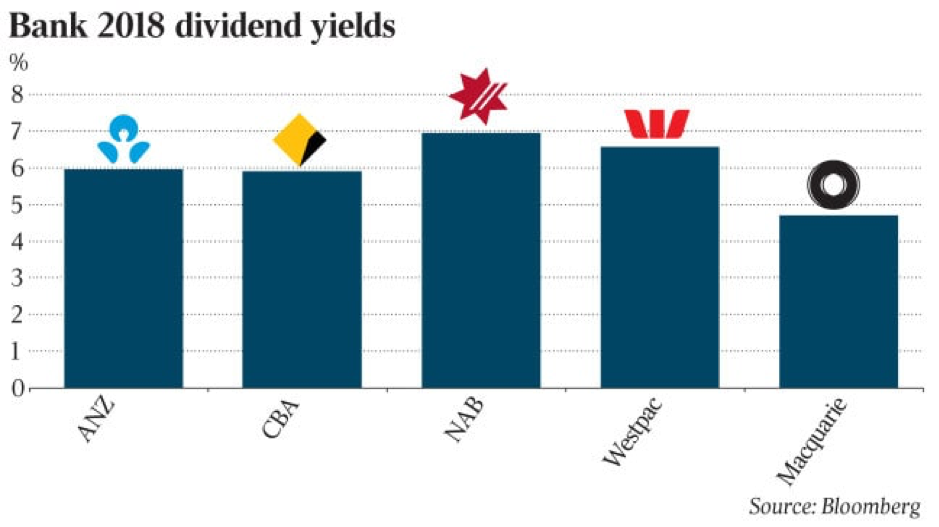

Any pullback in the share price will erode the value of the dividends converted into new shares, potentially wiping it out altogether: we are seeing this pattern just now in bank stocks, which are down about 5 per cent over the year to date.

But this works both ways. If the company’s stock price increases, investors who have taken additional shares in place of cash will probably receive a higher return over time, and their new shares will count towards their overall shareholding when the next round of dividends is calculated.

Put simply, over a long-term investment cycle, the broad statistics on asset returns show that money in the sharemarket has performed much better than money in a bank.

Holding a large amount of investable cash is not a sound option towards achieving better long-term returns and broader portfolio diversification.

Instead, investors should consider reinvesting their cash dividends into higher-yielding alternatives, including shares or into other asset classes.

Dividend reinvestment plans are a good cost-saving and effective option, and many companies offer them. So too are diversified equity funds that automatically reallocate cash dividends received across their holdings to maintain their portfolio investment weightings.