A road to big returns, minus the volatility

Written by Tony Kaye, the editor of Eureka Report, which is owned by listed financial services group InvestSMART, the following article appeared in The Australian on September 25, 2018.

IPIF executive director Nicole Connolly: ‘We actually think unlisted complements listed infrastructure.’ Picture: Stuart McEvoy

One of the greatest frustrations for private investors is the lack of access to infrastructure, an asset sector that has pumped up returns for larger super funds over many years.

Yet the road to infrastructure investing has become a lot easier for retail investors in recent years, with a plethora of listed shares and unlisted funds now available to those wanting exposure to this asset class.

Indeed, more SMSFs and private investors are finding ways to get into infrastructure assets such as airports, toll roads, regulated utilities including electricity, gas and water companies, as well as ports and railway networks.

These are typically privatised assets, sold off by either national governments in Australia and overseas, or by state governments and territories.

The attraction is that infrastructure assets provide investors with relatively predictable and stable cashflows over the long term, which due to contractual arrangements are often set to rise in line with inflation. As such, these types of assets are less prone to broader market volatility.

But a key question for all investors is whether it’s better to access infrastructure via listed companies on the ASX, or whether a better and less volatile course is through an unlisted infrastructure fund?

“It is possible to invest in infrastructure through direct shares or a managed fund, giving investors access to the advantages that this asset class offers, including a very attractive risk return profile with strong growth upside,” says 4D Infrastructure chief investment officer Sarah Shaw.

A partner of the well-regarded Bennelong Funds Management Group, 4D invests in listed infrastructure all over the world. “In fact, investing in listed infrastructure may be a better option for retail investors than an unlisted direct exposure,” Shaw argues.

The reason, says Shaw, is that investing in listed infrastructure gives access to the same underlying asset profile as an indirect or unlisted exposure.

Furthermore, both listed and unlisted investing employ the same valuation techniques, and there is regular movement of assets between the listed and unlisted space.

The main differences are in how an investor owns that asset profile, or how they gain exposure to the fundamental assets.

Investors in listed investments, rather than unlisted, generally benefit from:

- Greater diversity: If investors are gaining exposure through a fund of listed equities, they will be gaining exposure to a diverse stock portfolio covering different sectors and demographics.

- Greater liquidity: The listed sector has a shorter time to invest or divest. Investors in unlisted funds can face potential problems when trying to liquidate their holdings.

- Less acquisition risk: Direct investment needs intense due diligence, requiring a much larger team, and ultimately leads to greater portfolio concentration risk and limits the investor type.

- Greater in-cycle volatility: As listed assets are repriced daily, there is higher in-cycle volatility. However, this can present opportunities for active investors.

There is of course an opposite view. This is well-articulated by Nicole Connolly, executive director of funds management group Infrastructure Partners Investment Fund, one of the few avenues for private investors in unlisted infrastructure. Connolly says market volatility is one of the key reasons why unlisted infrastructure is a better option.

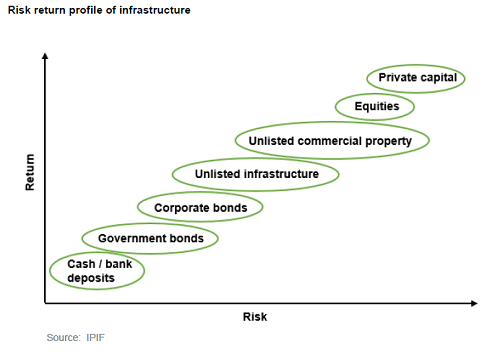

“Infrastructure, and particularly unlisted infrastructure, is attractive due to its typically stable, reliable returns and low correlation to equities. In a retail portfolio it sits between government bonds and equities in terms of risk return,” she suggests.

Unlisted infrastructure funds also tend to have exposures to a broader spread of assets, some of which are not available through listed securities.

For example, investors can readily access Sydney Airport and Auckland Airport shares on the ASX. However they can gain a much broader exposure to airports through unlisted funds that have indirect holdings in Melbourne, Perth, Brisbane, Adelaide, Launceston and other privatised domestic airports.

Another benefit of many unlisted funds is their exposures to offshore infrastructure assets in Asia, Europe and the US.

Connolly says unlisted infrastructure investments account for between 7 and 12 per cent of major institutional investor portfolios, with the Future Fund having around 7 per cent ($11.7 billion) allocated to infrastructure and Australian Super 12 per cent.

Unlisted returns have historically been around 9 per cent per annum, which is more than the yields from Australia’s top dividend stocks of the big four banks and well above term deposits.

“Couple this with the recent uncertainty over the future of franking credits and dividends and it is little wonder that more investors are increasingly considering the predictable and consistent returns of unlisted infrastructure,” Connolly adds.

Meanwhile, 4D Infrastructure’s Shaw says active management is particularly important when investing in infrastructure to position for all points of a macro economic cycle.

“Utilities meet basic needs and are largely immune to macro cycles, making them an attractive defensive, resilient asset class in depressed markets.

Perhaps the final word goes to Connolly.

“We actually think unlisted complements listed infrastructure. We don’t think it’s one or the other, but there’s a place in a portfolio for both listed and unlisted infrastructure.”

Frequently Asked Questions about this Article…

Infrastructure investments are appealing because they offer relatively predictable and stable cashflows over the long term. These assets often have contractual arrangements that allow returns to rise with inflation, making them less prone to broader market volatility.

Retail investors can access infrastructure investments through a variety of listed shares and unlisted funds. This includes investing in assets like airports, toll roads, utilities, ports, and railway networks.

Investing in listed infrastructure offers greater diversity, liquidity, and less acquisition risk. Listed investments provide a diverse stock portfolio and allow for quicker investment or divestment compared to unlisted funds.

Unlisted infrastructure funds are preferred by some investors due to their stable, reliable returns and low correlation to equities. They also offer broader asset exposure, including access to offshore infrastructure assets not available through listed securities.

Listed infrastructure investments experience greater in-cycle volatility as they are repriced daily, which can present opportunities for active investors. Unlisted infrastructure, on the other hand, is less volatile and offers more stable returns.

Active management is crucial in infrastructure investing to position for all points of a macroeconomic cycle. It helps investors navigate market changes and optimize returns from infrastructure assets.

Unlisted infrastructure returns have historically been around 9% per annum, which is higher than the yields from Australia's top dividend stocks and well above term deposits. This makes them an attractive option for investors seeking consistent returns.

Yes, listed and unlisted infrastructure investments can complement each other in a portfolio. Both have unique benefits, and having a mix of both can provide a balanced approach to infrastructure investing.