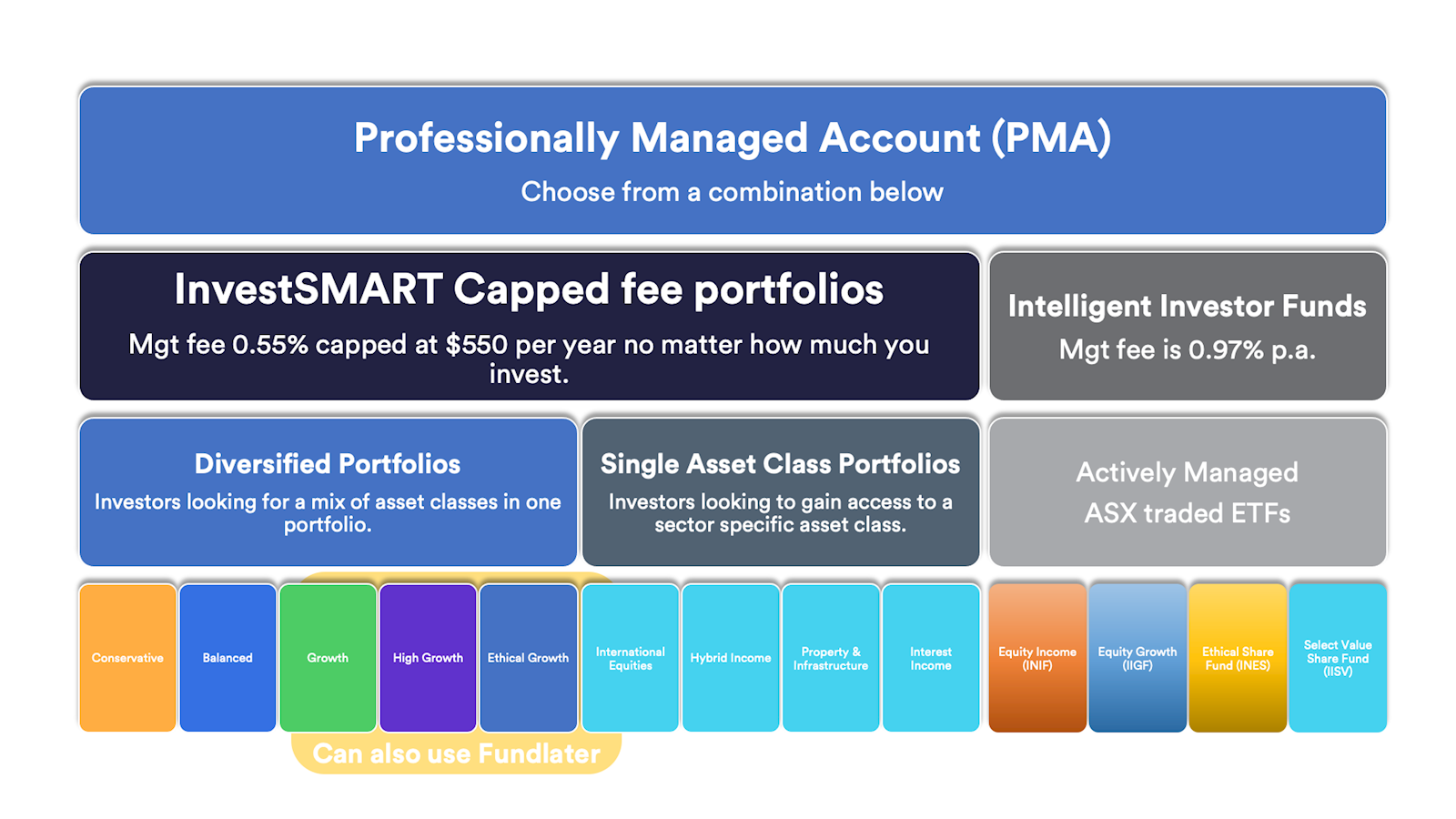

When you open an InvestSMART Professionally Managed Account (PMA), you choose from InvestSMART's range of Diversified Portfolios to invest in.

A list of the portfolios can be found here.

These managed portfolios comprise of Exchange Traded Funds (ETFs) or, in some cases direct shares. In particular, the InvestSMART Hybrid Income Portfolio invests in Australian listed hybrids and listed debt securities.

What is an Exchange Traded Fund?

An Exchange Traded Fund, or ETF, is a managed fund that trades on the stock market.

There are different types of ETFs, each with its own purpose, but most commonly, they will track or follow a particular index.

For example, if you want to follow or track the S&P ASX 200 (the top 200 Australian shares by market capitalisation), you could either buy each individual share (200 shares) or one ETF. The one ETF wraps up the 200 shares into one holding. By holding this one ETF, you get exposure to the movements of the ASX 200, less any fees.

Investing in ETFs is a form of passive investing, and they generally incur cheaper management fees, as fewer investment decisions are required to manage an ETF. They are also quite liquid and traded easily on an exchange.

You can see the holdings of each InvestSMART managed portfolio by navigating to its product page and scrolling to Key Facts > Holdings.

Saving for happy retirement

Saving for kids education

Saving for a property

Wealth Protection

Need help planning and finding the right investment portfolio?Get StartedBalanced Portfolio

Growth Portfolio

High Growth Portfolio

Ethical Growth Portfolio

Single asset class ETF portfoliosCash Securities PortfolioHybrid Income Portfolio

Australian Equities Portfolio

International Equities Portfolio

Property & Infrastructure Portfolio

Need help planning and finding the right investment portfolio?Get StartedConservative Portfolio Balanced Portfolio Growth Portfolio High Growth Portfolio Cash Securities Portfolio Hybrid Income Portfolio Australian Equities Portfolio International Equities Portfolio Property & Infrastructure Portfolio Ethical Growth Portfolio See all ETF portfolios How it works Capped fees Who we are Portfolios performanceETF Insights

Paul's Insights

Podcasts & videos

Portfolio updates

Top Performing ETFs

Compare Your Fund

Need help planning and finding the right investment portfolio?Get Started